In the beverage alcohol industry, the holiday season spells O-N-D. That stands for October, November, and December, representing a dizzying period of rapid fire fourth quarter sales for everyone in the drinks business, from suppliers, to distributors, to retailers — and most certainly for bars and restaurants.

This Q4 “OND” period is indeed the most important quarter for on-premise alcohol sales. Nearly 30 percent of on-premise sales happen in this period at Union bars and restaurants, followed by the summer period, which represents about 25 percent of annual sales.

At off-premise outlets, Q4 sales represent an even bigger piece of the pie, particularly when you consider how retail alcohol sales have increased since the height of the pandemic, according to Layne Cox, Union’s chief marketing officer.

But there’s plenty of room for optimization at bars and restaurants, as well. “The OND period represents huge sales opportunities for on-premise venue operators who understand how guest preferences play out,” she says.

To help operators and brands dial in their holiday plans, OnPrem Insights analyzed consumption data from Q4 2022 to find the top insights for making the holiday period a success.

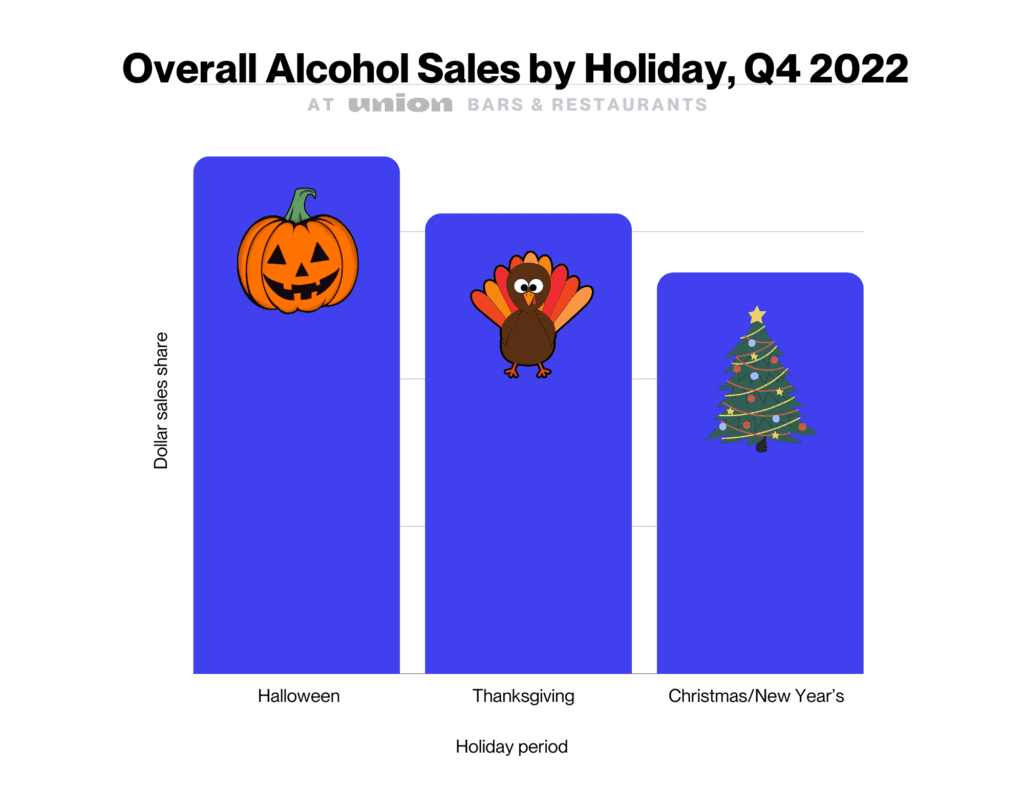

Halloween Saturday is the Biggest Sales Day of the Year

Halloween should be top of mind for operators, and for good reason.

The 10 biggest sales Saturdays of last year happened in OND. And the Saturday before Halloween was the biggest of all, topping the charts for alcohol sales at Union bars and restaurants in 2022. What’s more, the Saturday after Halloween was the fourth highest selling day — even higher than New Year’s Eve that year.

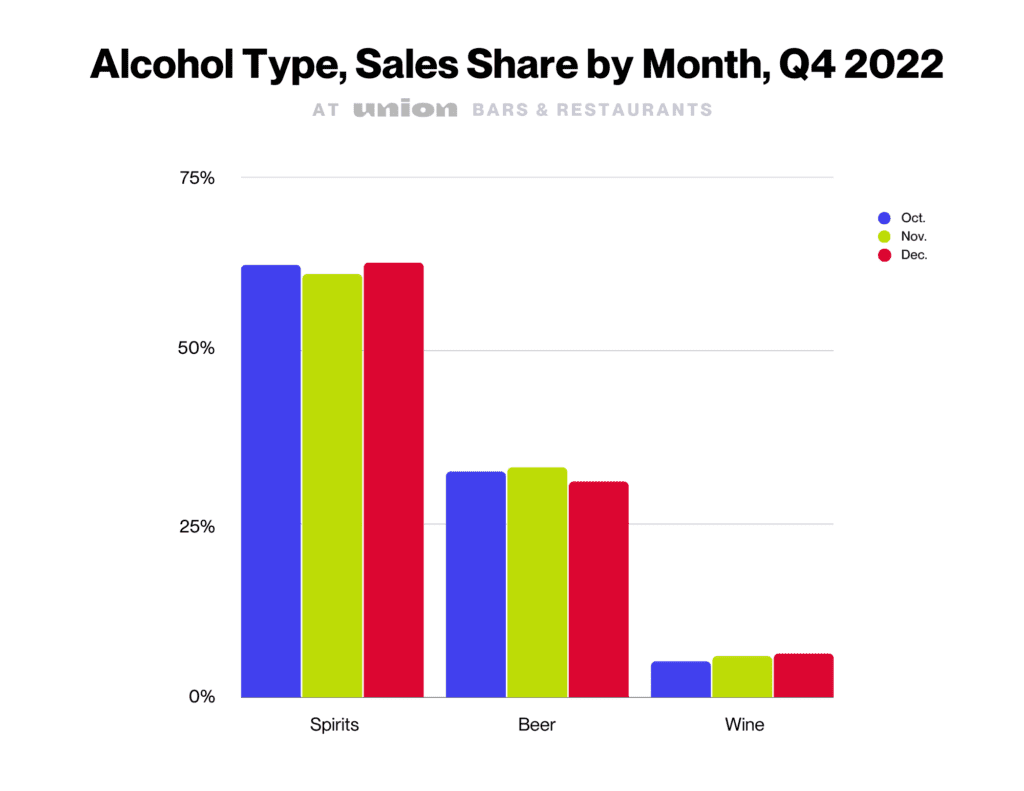

The month of October also represents a high share of Spirits sales, almost on par with December. Sixty-two percent of all alcohol sold at Union in October 2022 was Spirits.

December Alcohol Sales Peak Early — Well Before New Year’s Eve

Month by month, sales peak in October and decrease slightly into November and December, likely due to the fact that Thanksgiving and Christmas are more family- and home-oriented celebrations, and thus stronger for retail sales. But weekends in December are still substantially busy for on-premise venues, with the exception of Christmas week.

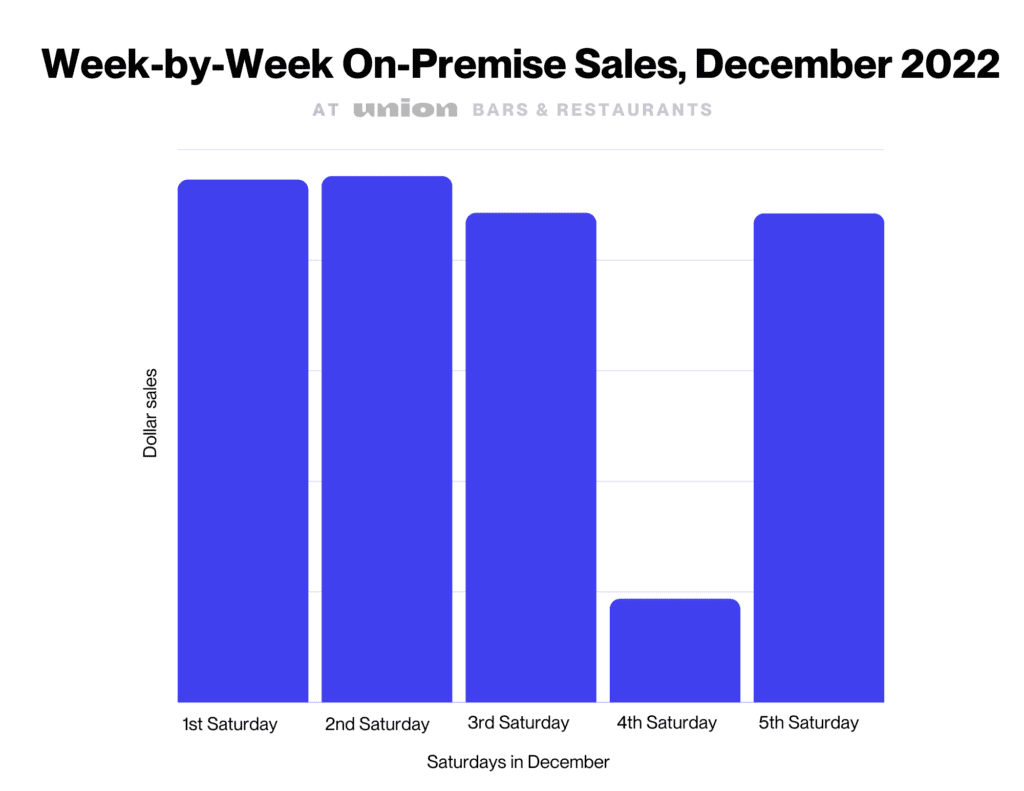

The second Saturday in December was the second biggest sales day of the year in 2022, with sales also notably high on the Friday of the same weekend. The first Saturday in December was the year’s third biggest sales day. Despite busy schedules and family commitments, guests seem ready to ring in the holidays at on-premise venues in December, well before New Year’s Eve.

Operators should strategize around these dates with promotions that will bring in revenue, like higher-priced drink specials and holiday-themed programs. Keeping an eye on the day of the week a holiday falls on matters, too. In 2022, for example, the fourth Saturday was Christmas Eve, and the fifth was New Year’s Eve, greatly impacting those daily sales.

Maximizing Thanksgiving and New Year’s Alcohol Sales

Thanksgiving Day is a low point for Q4 sales, along with Cyber Monday, Christmas, and the first weekdays of January. But operators shouldn’t totally discount November: The Wednesday before Thanksgiving was still the biggest Wednesday of the entire year at high-volume venues, in part because many people have the day off, and some younger drinking-age consumers participate in “Drinksgiving,” a bar-focused gathering of friends the night before Thanksgiving.

The average price of a Wine order also shifts markedly during the holidays. “We were surprised to see how high the average price of wine orders jumps on the end-of-year celebratory holidays,” says Cox. While average order prices for Beer and Spirits don’t rise much during the holidays, according to Union data, the price of an average Wine drink spikes to nearly double — to $20 per drink on Christmas Eve and $19 on New Year’s Eve.

“Guests are eager to celebrate on those nights, and they’ll pay a premium to do so. These are key days for bars and restaurants to cash in on their Wine inventory, especially on pricier brands that sell well in the holiday season,” she adds.

Wine sells a larger share in Q4 compared to the rest of the year, representing about nine percent growth in that quarter. On Christmas Eve, about 22 percent of Wine sales are sparkling wines, while on New Year’s Eve sparkling represents over 50 percent of all Wine sales.

And though December sales are the lowest in all of OND, one high point is the first Saturday of that month, possibly due to office holiday parties or friends going out before family holiday events take priority.

Know What Sells Best in the Fall

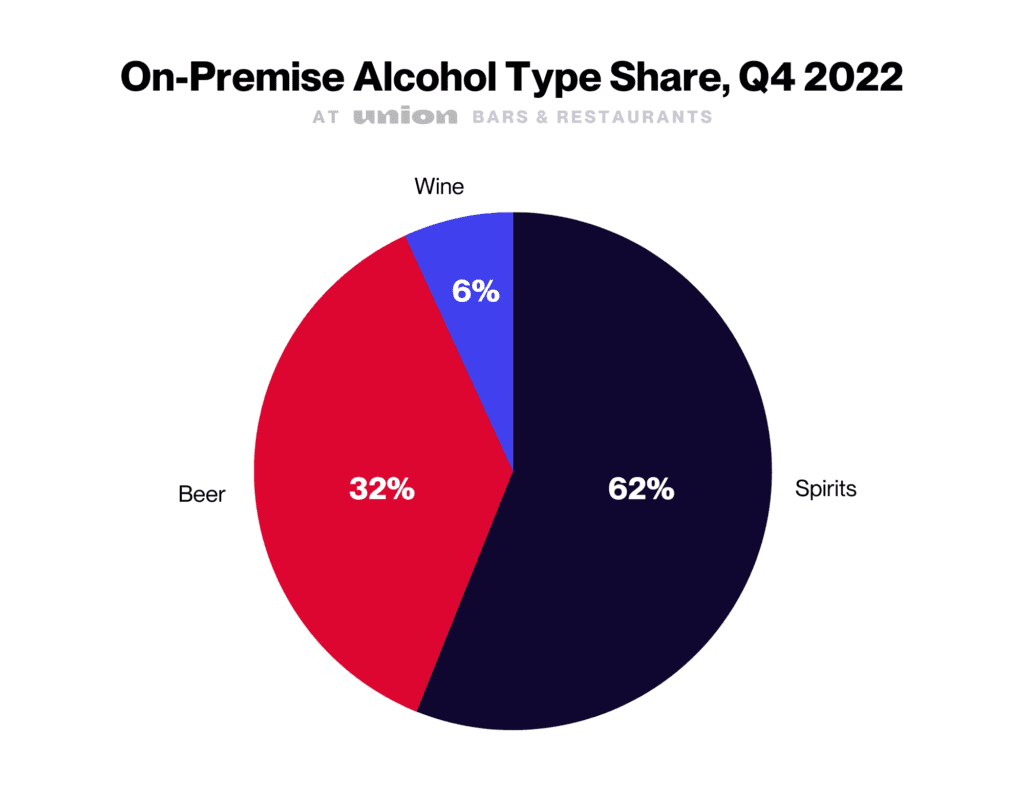

Spirits account for over 60 percent of on-premise sales in the Q4 period.

While that’s on par with on-premise alcohol sales throughout the year, customer preferences do fluctuate month-to-month. Spirits dip slightly in November and go back up in December, for example. Wine rises slightly later in the year. Beer sales rise through October and November before dipping in December, as well. “In November, Beer sales also hit their highest point in the quarter,” Cox adds.

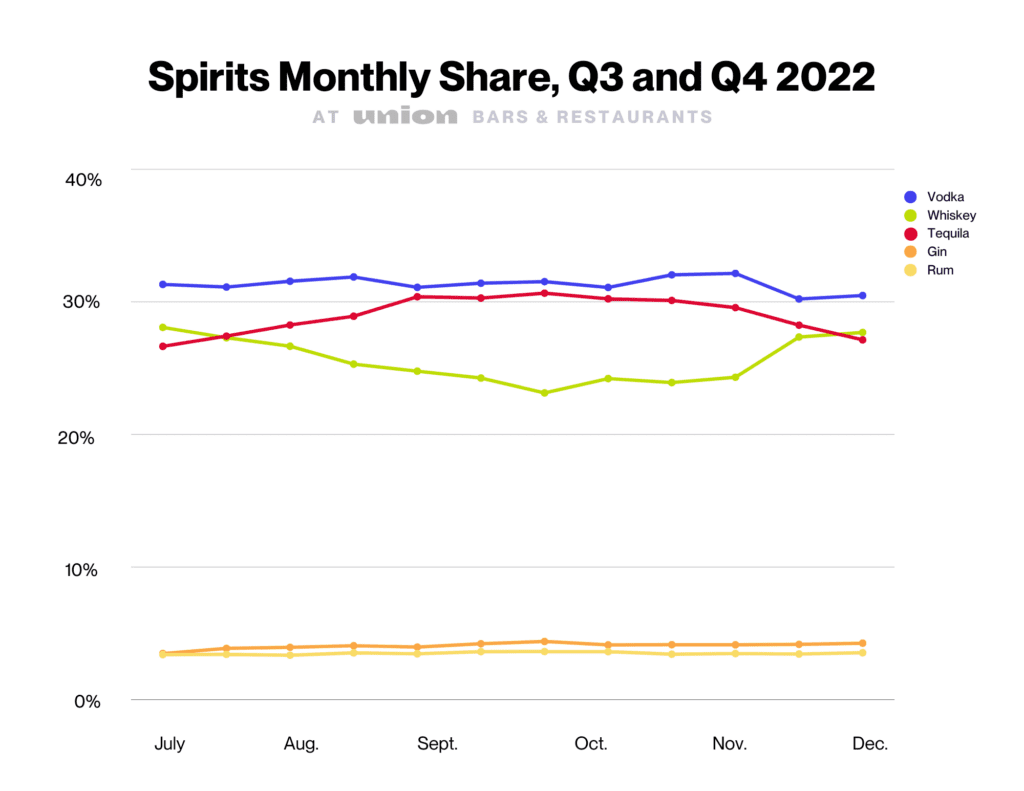

Within Spirits, Vodka’s share of all Spirits peaks in October (32 percent), then dips slightly in November and December. However, Tequila and Whiskey play out more seasonally, with Tequila dropping below Whiskey to No. 3 late in the year just as warming Old Fashioneds become more desirable than refreshing Margaritas.

“By December, Whiskey is up 3 points at almost 29 percent share. It’s a subtle but notable seasonal shift that shows Whiskey’s steadfast popularity in the colder months,” notes Cox.

The Top Spirits and Cocktails of Q4

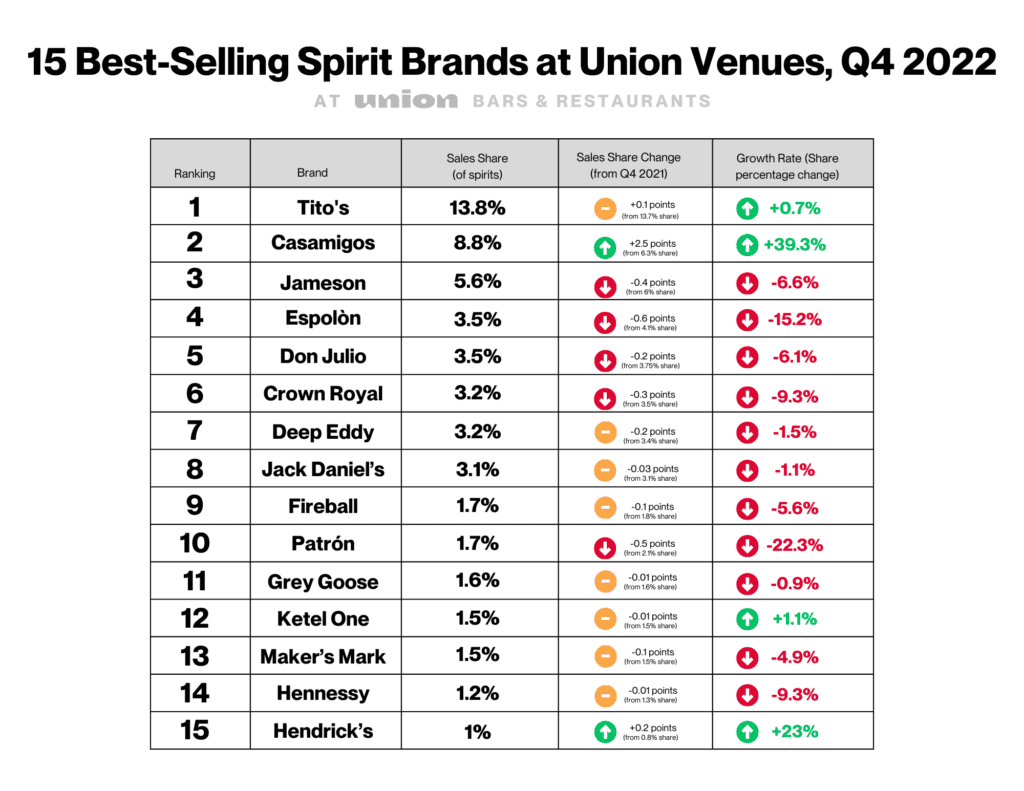

Familiar brand names make the list of top-selling 2022 Q4 Spirits at Union bars and restaurants. However, just a handful of brands experienced growth compared to the same OND period in 2021.

Source: OnPrem Insights, October 1 to December 31, 2021 and 2022. Ranked by dollar sales share.

Tito’s Handmade Vodka reigns supreme in the fall season — as it does year-round — beating out all other brands at nearly 14 percent share of all Spirits sold at Union bars and restaurants. Its growth in this Q4 period, compared to 2021, was relatively flat, though it’s still unchallenged by the other Vodkas on the list.

Casamigos may be trailing Tito’s, but it was the star Spirit in Q4 2022, with an envious growth rate of almost 40 percent compared to Q4 2021. None of the other top Tequila brands come close to its Spirits share, and in fact all lost share from the previous period.

Only one other brand, Hendrick’s, also showed impressive growth. “Gin sells well in the fall, plus classic cocktails like the Martini are trending on-premise,” says Cox. “So even though Hendrick’s represents a small share of Spirits sales at Union venues, its growth is representative of a larger trend.”

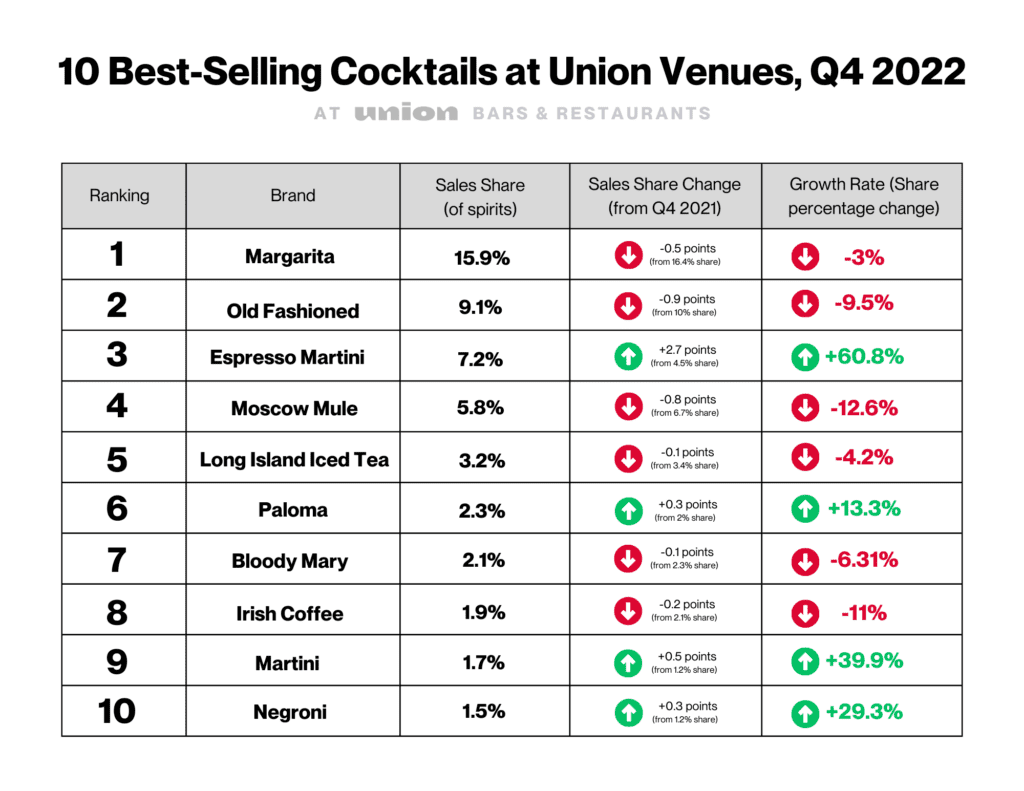

Also trending is the Espresso Martini. “Get ready to shake Espresso Martinis this fall,” says Cox.”Guests still can’t get enough of them.”

The Espresso Martini had a stellar performance on-premise last year, with sales up by 61 percent to hit 7.2 percent share of all Cocktails sold in Q4, effectively bumping the Moscow Mule down from spot No. 3 for the quarter. While Martinis and Negronis represent a much smaller share by comparison, they are also gaining in popularity.

As operators strategize to get ahead of the busy season, and all signs point to a happy and healthy rise in 2023 OND sales for these classic cocktails. By looking back at overall guest ordering trends, bars and restaurants can better prepare for the busy 2023 holiday season, with the insight that the “O” in OND (October) holds a great deal of potential for Q4 sales of Cocktails, Spirits, and more.