New data from Union’s OnPrem Insights shows that Tequila has finally done it: The agave spirit edged out Whiskey for category share in the last year by two percentage points. The findings are based on data from actual guest purchases at high-volume bars and restaurants across America, in the 12-month period ending March 31, 2023.

Certainly, Tequila’s rapid growth is undeniable across all corners of the alcohol industry. But in a show of the spirit’s market strength in the on-premise, Tequila’s best selling subcategory on Union — 100-percent agave Silver (Blanco) — grew in share despite price-per-drink increases over the past year. And the highest-priced, top-end Tequilas proved to have significant presence as well, even into the late-night hours.

Note: The scope of this report does not include Tequila-based RTDs.

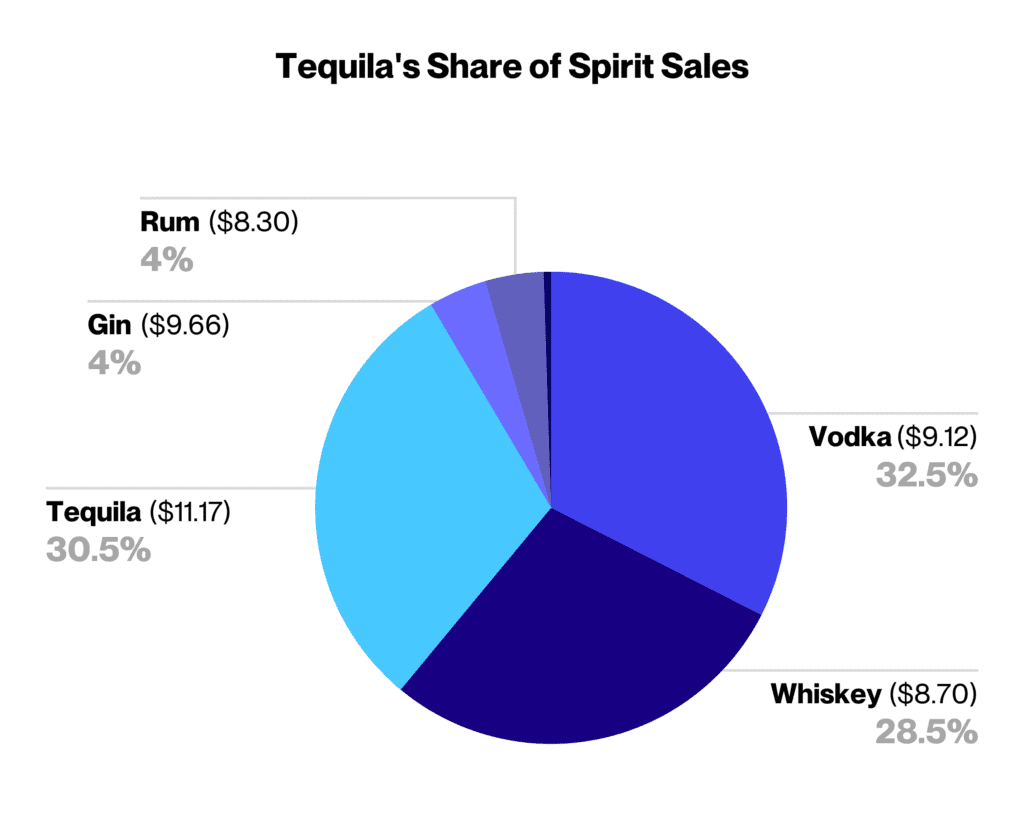

Tequila is Nearly One-Third of All Spirit Sales on Union

Due to seasonal shifts, we see that Whiskey took the lead in the colder months and Tequila in the warmer months. But despite this seasonal dance, Tequila came out ahead of Whiskey overall with a higher share of spirits sales in the on-premise. Though Tequila had a big win during this period, Vodka remained the top winner across all spirits.

“Now there’s no doubt Tequila is in the holy trilogy of spirits even at high-volume independent bars and restaurants, right alongside Vodka and Whiskey,” said Layne Cox, Chief Marketing Officer at Union. “Right now, those three categories represent a combined share of more than 90 percent of spirits sales.”

Cox added: “We’ve been watching Tequila and Whiskey vie for second place for some time, and this 12-month data confirms that Tequila has now earned the No. 2 spot in Union venues. If you’ve been wondering just how popular Tequila has become, let this be your signal to focus wholeheartedly on your Tequila program.”

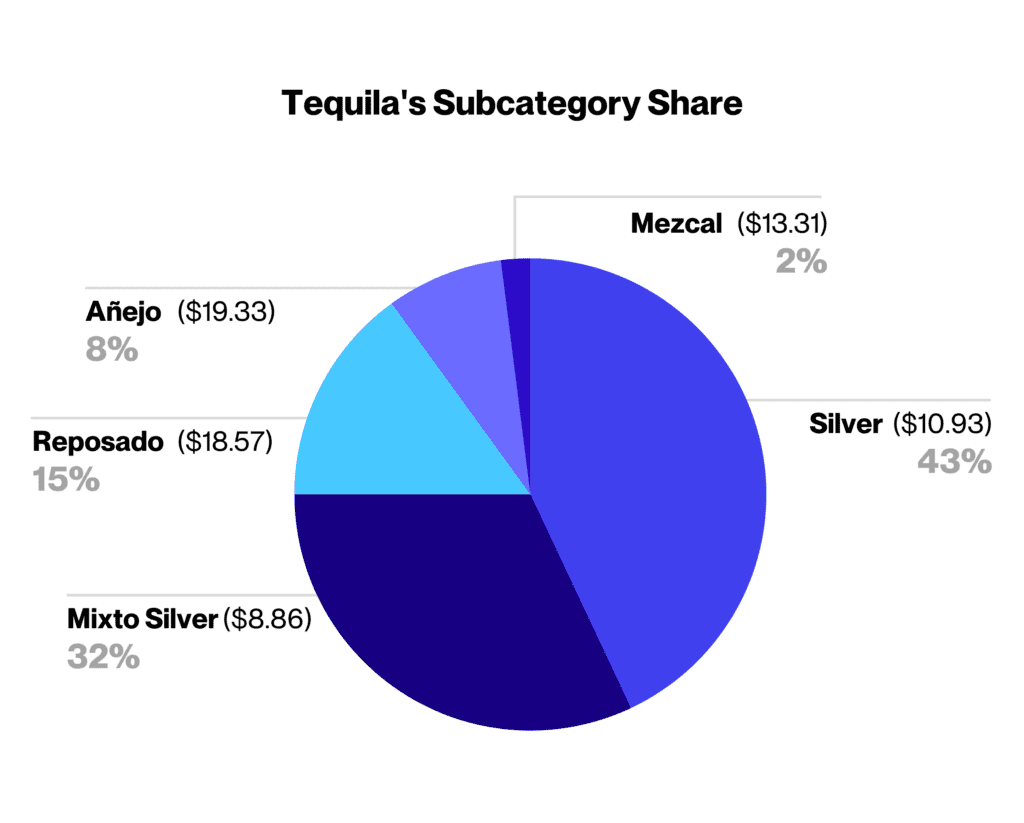

Silver and Higher-Priced Tequila Sell on Union

Silver Tequila sells very well at Union venues. Comprising brands made with 100 percent agave, Silver Tequila won subcategory share at 43 percent during this period, followed by Mixto Silver (made with at least 51 percent agave) at 32 percent. Rounding out the Tequila category with share above 1 percent were Reposado (15 percent), Añejo (8 percent), and Mezcal (2 percent).

The overall appetite for agave-based spirits is growing. Despite higher-than-average pricing, Tequila drinks are selling extremely well. Over the past year, Tequila drinks — meaning any drink that includes Tequila, from shots to highballs and cocktails — averaged $11.17, a significant difference compared to Vodka ($9.12) and Whiskey ($8.70) drinks.

In fact, higher-priced Tequila drinks, which include Reposado ($18.57), Añejo ($19.33), and Mezcal ($13.31), represent a robust 25 percent of all Tequila drink purchases, indicating that the premiumization trend is strong even at larger venues and that guests are branching out beyond the basics to try new expressions of agave — even when they’re more expensive.

If that’s not enough to prove that Tequila is recession-proof, consider that even though the price of Silver Tequila drinks increased by two percent during this period, the subcategory nonetheless increased its share of sales by one percent. By comparison, Mixto Silver’s drink price stayed steady but dropped in share by three percent over the same period.

Note: For the purposes of representing comprehensive agave spirits share, Union is including Mezcal in this report.

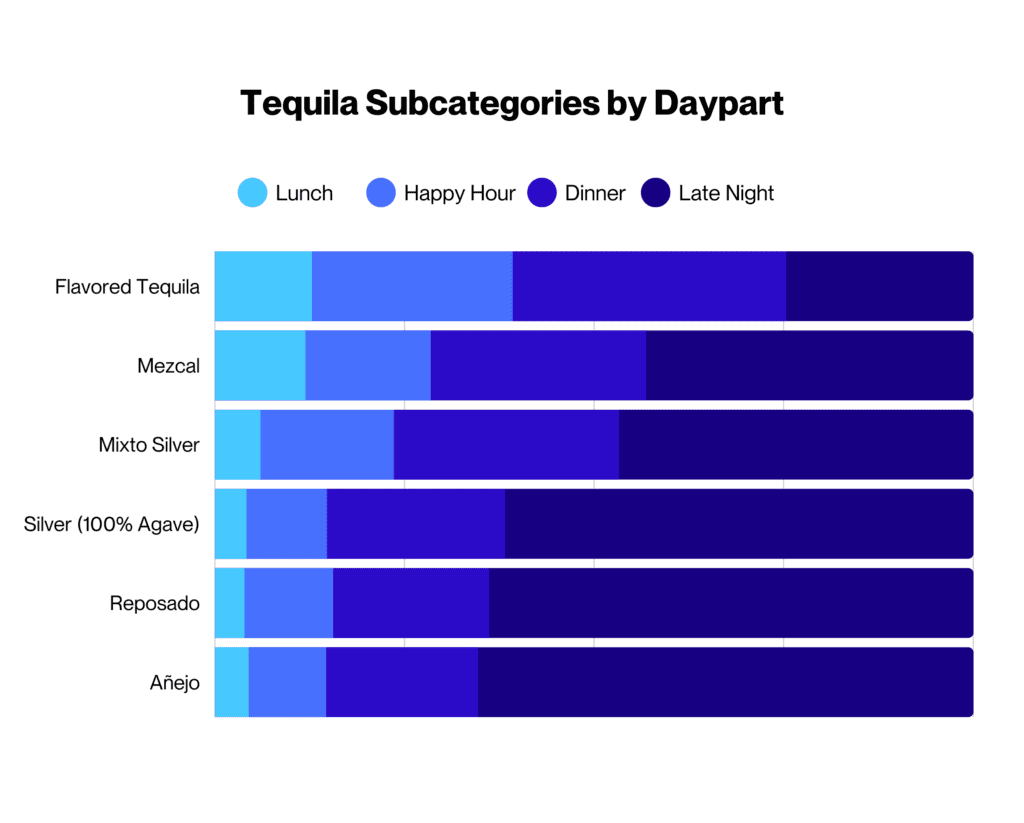

Late Night Loves Premium Tequila

While the growing Tequila premiumization trend has long been reported on, it’s been unclear exactly where and when customers are drinking the highest-priced Tequilas. As it turns out, customers at high-volume venues are indeed embracing sophisticated, top-end Tequilas, especially in the Late Night hours.

Union data reveals that sales for the three highest-priced Tequila subcategories — Reposado, Añejo, and Mezcal — spike significantly in the Late Night hours (after 10 pm) at high-volume venues. Mezcal rises steadily from Happy Hour (4 pm – 7 pm) on, whereas Reposado and Añejo consumption rises from Dinnertime (7 pm – 10 pm) on through Late Night.

Sales Opportunities: The Sky’s the Limit

“We wanted to see if the Tequila trends we read about in the off-premise also held true at the thousands of high-volume venues in Union’s network,” noted Cox. “Our data shows that consumers’ love for Tequila is indeed at an all-time high, and that the thirst for premium Tequila is as strong as ever, even as prices rise.”

On-premise operators simply can’t go wrong selling Tequila these days. But that doesn’t mean there isn’t room for even more sales from this category by keying in on fresh growth strategies.

Recommendations for Venues

- Treat Tequila Like Whiskey – Spotlight artisanal, higher-end Tequilas as a menu special, especially in the late-night hours.

- Lean Into Upsell Opportunities – Create Tequila flights of varying prices and cocktails with suggested, brand-specific upsells to encourage trial of premium products.

- Market Signature Cocktails – Become known for your own riff on a Tequila cocktail by branding it as a signature drink, like Bar X’s Famous Top-Shelf Margarita.

Recommendations for Brands

- Educate to Upgrade – Help eager-to-learn customers expand their love for agave spirits and cocktails with a well-planned education strategy.

- Push Your Premium Labels – Even in busy, high-volume settings, customers are clamoring for the good stuff, especially at Late Night. Suggest your brand as a premium frozen shot or as a cocktail floater.

- It’s a Good Time to Experiment – There’s much room for innovation and growth in the cocktail space. Market your brand as the preferred spirit in riffs like a Reposado Paloma or an Añejo Mexican Martini.