What spirits are customers looking for at high-volume bars and restaurants? Quite often, it’s Vodka.

The versatile liquor accounted for nearly one-third of all spirits sales at Union bars and restaurants, not including RTDs, in the 12-month period ending June 30, 2023. Texas-based brand Tito’s outsells all Vodka brands at Union, but other iconic brands and a slew of distinctly premium and flavored options seem to keep customers engaged with this all-time classic spirit.

IWSR data shows that globally, the Vodka category has been largely flat and is expected to remain so, though innovation with premium and flavored varieties has kept sales resilient. While the category isn’t showing growth, per se, Vodka has been steadfast at Union’s high-volume venues, holding steady at over 30 percent share in the 24-month period ending June 30, 2023. The average price of a Vodka drink (any drink featuring Vodka — from shots to cocktails) is $8.36, up by 20 cents in the last 12-month period, making it a more affordable option than Tequila drinks ($10.61), and on par with Whiskey drinks ($8.41).

“Vodka is a year-round sales leader for high-volume bars and restaurants,” says Gary Ross, chief growth officer at Union. “What’s astounding is that Vodka sales have held strong in the past two years at Union bars and restaurants, even in the face of fierce competition from Whiskey, Tequila, and RTDs — a sign of the unshakable strength that makes it a key player in on-premise beverage programs.”

Tito’s Leads Vodka Sales — and is Still Growing

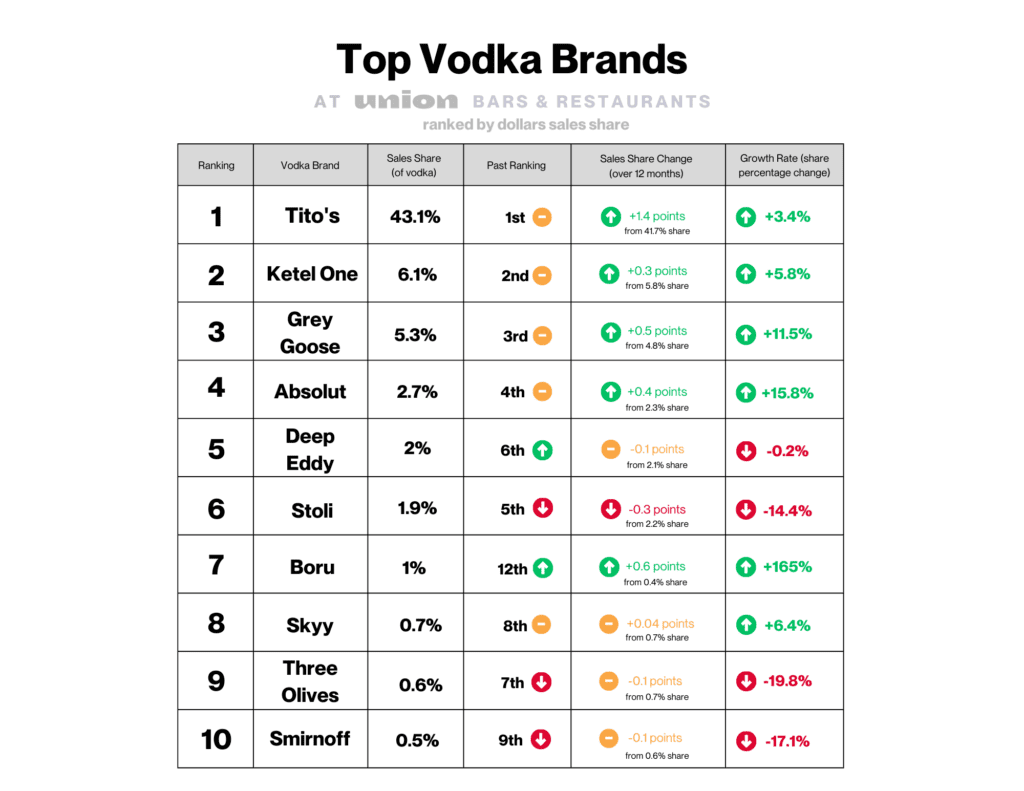

Tito’s Handmade, an independently owned Texas mega-brand with craft appeal, dominates on-premise Vodka sales at over 43 percent share of all Vodka sold at Union venues. And it’s steadily growing, having increased its share by nearly one and a half points over the last 12-month period.

Ketel One (6.1 percent) and Grey Goose (5.3 percent) each have a solid share, and together with Tito’s account for more than half of all Vodka sales at Union venues.

“Tito’s shows no sign of losing its No. 1 spot at Union venues anytime soon,” says Ross,” but well-known brands like Ketel One and Grey Goose are in a good position to maintain a healthy share of Vodka sold on-premise.”

Amongst other top-selling brands including Absolut and Deep Eddy, there’s a healthy sense of competition, with lots of movement in share change, but little change in overall rankings. In other words, brand positioning has remained solid for the top names even though there is some movement in share change.

House/Well Vodka brands, which are not identified on a menu, account for 32 percent of sales share.

Because Tito’s and Deep Eddy are the only U.S.-based Vodka brands in the Top 10 (both hailing from Austin, Texas), we have ranked Vodkas based on national sales excluding Texas to remove regional skew. Within Texas, Tito’s still reigns supreme in the No. 1 spot, though Deep Eddy ranks much higher than it does nationally, at No. 2. Together, the two local brands comprise more than 65 percent dollar sales share of all Vodka sales within Union’s Texas venues.

With Vodka’s clear historical link to Russia, the years-long rise of U.S.-based Vodka brands may seem unlikely. However Russian-made Vodka accounts for a very small percentage of U.S. sales, according to the Distilled Spirits Council. Still, negative consumer perception may prevail in light of Russia’s war with Ukraine. Vodka icon Stoli rebranded last year to sever ties to its Russian backstory. The move, reportedly made to better represent the brand’s Latvian roots and anti-Putin stance, still saw nearly a 14 percent decline in dollar sales this period.

Ross explains: “We see movement in dollar sales by share, with some brands seeing better growth than others in this period. Still, most Vodka brands ranked solidly at Union venues. Of the Top 5 performing brands, their rankings didn’t budge in the past year, proving that brand loyalty is very much at play.”

At On-Premise Venues, Flavored Vodkas Take Off

Guests are paying attention to Vodka brands — and flavors — more than ever before.

The spirit has long been prized for its neutral flavor, making it one of the most versatile, mixable spirits. But flavored Vodkas are gaining steam. The latest market predictions say that the flavored segment is expected to grow at 6.5 percent CAGR globally through 2030, according to a recent report by Grand View Research. Per the report, the demand for high-end flavored Vodkas, especially among the Millennial population, is one of the major factors driving Vodka growth across the globe.

These days, citrus Vodka is king in American on-premise venues, according to Union data. Lemon, orange, and grapefruit are among the most popular flavors sold this period, along with berry flavors. Refreshing but more savory flavors like cucumber, tea, and vanilla show widespread traction, as well.

Most Popular Vodka Flavors at Union Venues

Ranked by numbers of units sold

- Lemon

- Raspberry

- Citrus

- Orange

- Berry

- Vanilla

- Cucumber

- Mandarin

- Grapefruit

- Pink Lemonade

Gone are the days of sweet dessert flavors, replaced in the category by more natural-sounding and authentic flavors, like cucumber-mint and passion fruit. Today’s Vodka flavor innovation is about simplicity, “better-for you” concepts, and farm-fresh flavor trends. Pure expressions and classic combinations seem to resonate broadly with guests. Ross adds: “Several brands, like Deep Eddy, are known by Union guests primarily for their fresh and simple flavors.”

Top-Selling Flavored Vodkas at Union Venues

Ranked by dollar sales share

- Deep Eddy Lemon

- Absolut Citron

- Deep Eddy Ruby Red

- Stoli Razberi

- Stoli Ohranj

- Stoli Blueberi

- Stoli Vanil

- Absolut Mandarin

- Ketel One Botanical Cucumber and Mint

- New Amsterdam Pink Whitney

The Fastest-Growing Vodkas at Union Venues

According to Union data, these brands and items proved to be the fastest-growing Vodkas, based on their rank change during the 12-month period ending June 30, 2023.

Fastest-Growing Vodka Brands at Union Venues

Sorted by rank change

- CleanCo

- Pilot House Distilling

- Mullholland

- White Claw

- Simple Vodka

- Western Son

- Ocean Organic

- Van Gogh

- Finlandia

- Saratoga Courage

Coming in at the No. 1 fastest-climbing brand is CleanCo, a non-alcoholic Vodka, which jumped 72 places into the Top 50 of all Vodka brands sold at Union venues. Notably, White Claw’s new premium Vodka line also made the list. It launched earlier this year, so we’re just seeing the beginning of what’s likely to be an upward trajectory. The other movers and shakers are noteworthy for their premium positioning — whether as a celebrity-backed brand or one with a charitable cause, or boasting super-filtered or organic methods.

Fastest-Growing Non-Flavored Vodka Items at Union Venues

Sorted by rank change

- Bar Pilot Traditional Vodka

- White Claw Premium Vodka

- Mulholland Vodka

- Western Son Vodka

- Simple Vodka

- Stoli Elit Vodka

- Van Gogh Vodka

- Cathead Vodka

- Ocean Organic Vodka

- Wild Roots Sun Ranch Vodka

Fastest-Growing Flavored Vodkas at Union Venues

Sorted by rank change

- CleanCo Clean V Apple

- Stoli Cucumber

- Deep Eddy Grapefruit

- UV Blue

- Svedka Vodka Blue Raspberry

- Finlandia Grapefruit

- New Amsterdam Pink Whitney

- Deep Eddy Cranberry

- Smirnoff Whipped Cream

- Absolut Watermelon

Stoli Cucumber is one to watch, leaping 49 spots among all Vodka products, and leading growth compared to other cucumber-flavored Vodkas. Other standouts operators should take note of are tart flavors like grapefruit and cranberry, as well as blue raspberry profiles.

Ross notes: “White Claw didn’t make this list but it’s one to watch, especially in regards to its flavor offerings, which have already proved popular in the RTD space.”