Modelo may be the best-selling beer in America at retail, but at bars and restaurants, it’s a different story — at least for now.

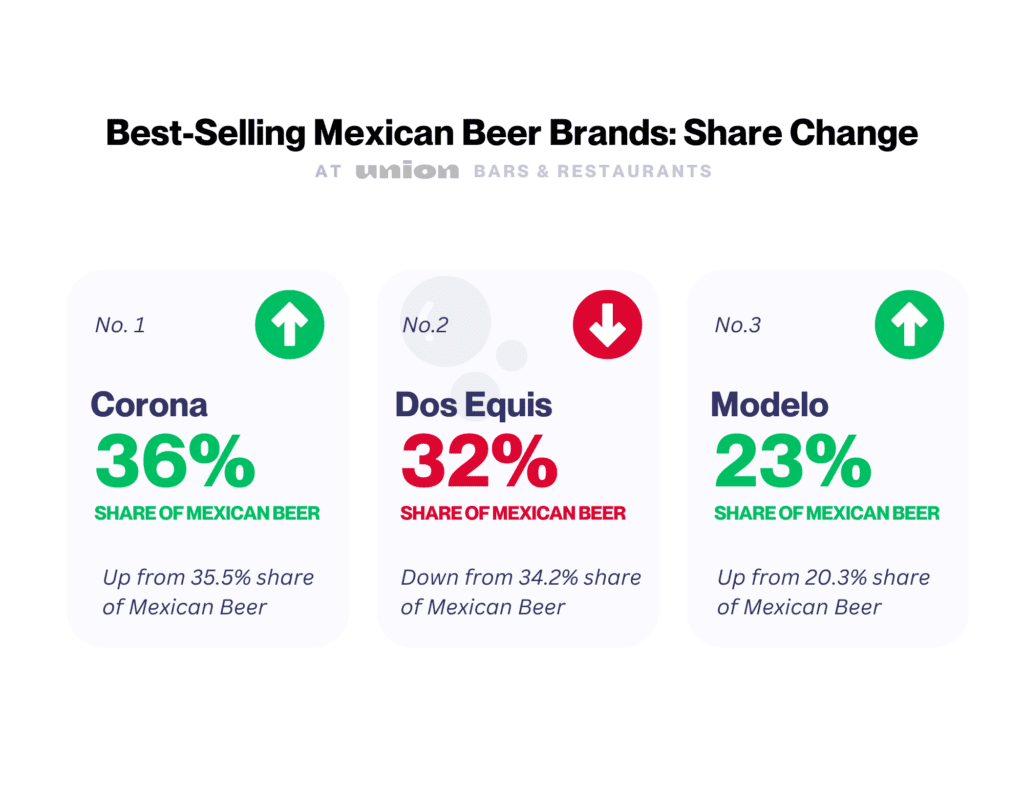

Last year, the Modelo brand made headlines at the height of the Bud Light controversy, when Nielsen IQ data showed it rose to the No. 1 spot in retail sales, dethroning Bud Light’s 20 year reign. But at on-premise venues, Modelo ranks as the No. 3 best-selling Mexican beer, after Corona and Dos Equis, according to the latest guest-ordering data from Union’s high-volume bars and restaurants. Across all beer subcategories, Modelo ranks as the ninth best-selling beer overall.

“Corona and even Dos Equis had sort of a head start when it came to prominence in the U.S. beer market,” explains Dave Williams, president of Bump Williams Consulting, “so those brands had a foothold in the on-premise long before Modelo became a top priority.”

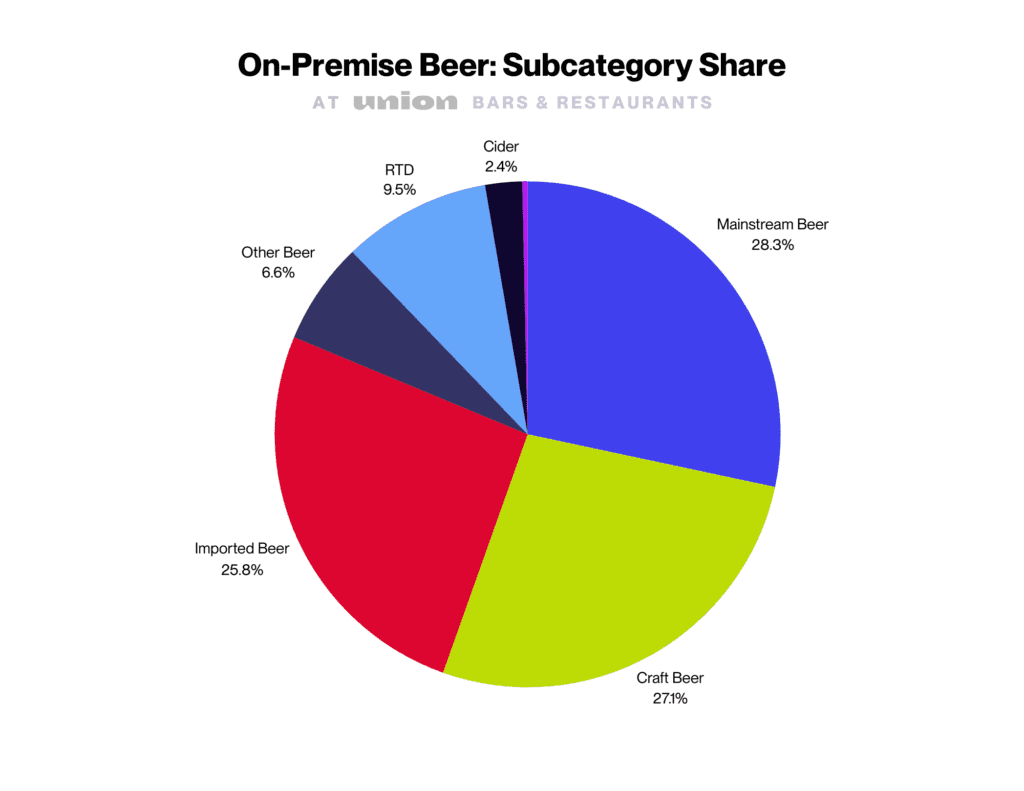

Popular Mexican lagers like Corona and Modelo aren’t just dominating the category of Mexican Beer imports. They now make up about 14 percent of all on-premise beer sales, and over half of all on-premise beer imports.

And Mexican Beers keep growing in popularity with guests. While Mainstream and Craft Beer sales are declining on-premise, same-store sales of Mexican Beer grew by 4 percent in 2023 at Union venues, with much of that expansion due to Modelo’s steadfast status as the fastest-growing brand in this import category.

Corona and Dos Equis Lead Sales, While Modelo Grows

Nearly all Mexican Beer imports sold on-premise are Corona, Dos Equis, and Modelo. These highly recognizable brands represent over 90 percent of all Mexican Beer sold at Union.

Corona is more than just the top-selling Mexican Beer brand on-premise — it’s also the No. 5 top-selling Beer brand overall at Union venues, and last year it grew its share of the Mexican beer category by about 1.3 percent, outperforming Dos Equis, whose share has dropped significantly with mixed performance even amidst renewed marketing efforts by the brand.

“In the past year, the gap has widened between Corona and Dos Equis, with guest orders for Dos Equis down by more than 5 percent,” says Gary Ross, Union’s chief growth officer. Union data shows that Dos Equis drinkers aren’t switching to other Mexican beer brands, like Modelo. Instead, they are ordering more Miller Light, Michelob Ultra, and Coors Light, especially since last spring.

“Dos Equis took a hit during the pandemic, and then it wasn’t able to capitalize on the Bud Light boycott the way other brands did last year,” Ross says. It’s still a top performer on-premise, but the data shows its popularity is declining.

Though Modelo currently represents an overall lower share of Mexican Beer sales than Dos Equis or Corona, its growth trajectory is promising. Its share of the Mexican Beer category grew nearly 13 percent during the last year, following steady on-premise growth since about January 2023.

As Williams observes, “Corona is still a massively popular brand, and growing in a lot of markets, so it hasn’t exactly been an easy brand to overtake due to lack of presence and/or performance.”

He adds: “Modelo was already on a growth trajectory and not many consumers that left the Bud Light brand in the wake of the controversy were interested in trading up to an import brand, but were instead interested in finding a cost-equivalent replacement. For Dos Equis, I think this is just more of a continuation of what was already taking place in lager-drinking consumers, seeking alternative options either due to price, relevance, or accessibility.”

The Top-Selling Mexican Beer Brands

In the Top 10 of Mexican Beer brands, Pacifico and Tecate rank fourth and fifth, respectively. However, both brands experienced declines during the past year according to Union data, with Pacifico’s category share down by nearly 17 percent and Tecate by about 12 percent.

Carta Blanca grew its share last year to rank as the No. 8 best-selling Mexican Beer at Union, overtaking Sol, now No. 9, though these brands sell significantly less on-premise than the top three brands: Corona, Dos Equis, and Modelo.

Top Ten Mexican Beer Brands at Union Bars & Restaurants

- Corona

- Dos Equis

- Modelo

- Pacifico

- Tecate

- Estrella Jalisco

- Victoria

- Carta Blanca

- Sol

- Bohemia

Source: OnPrem Insights by Union. 12-months ending December 31, 2023. Based on dollar sales share.

In the Top 10 of beer brands overall at Union venues, Corona ranks fifth, Dos Equis seventh, and Modelo ninth, in a bold display of Mexican beer’s on-premise popularity.

On-premise penetration is a key to the sustained growth of Modelo, explains Williams, and while on-premise was not as high a priority for Modelo initially, he expects its positioning to climb as it expands its presence in bars and restaurants.

With Modelo’s projected growth, Imported Beer’s share of all beer could continue to grow — and potentially rival — Craft and even Mainstream Beer at Union bars and restaurants.

Where is the Growth Coming From?

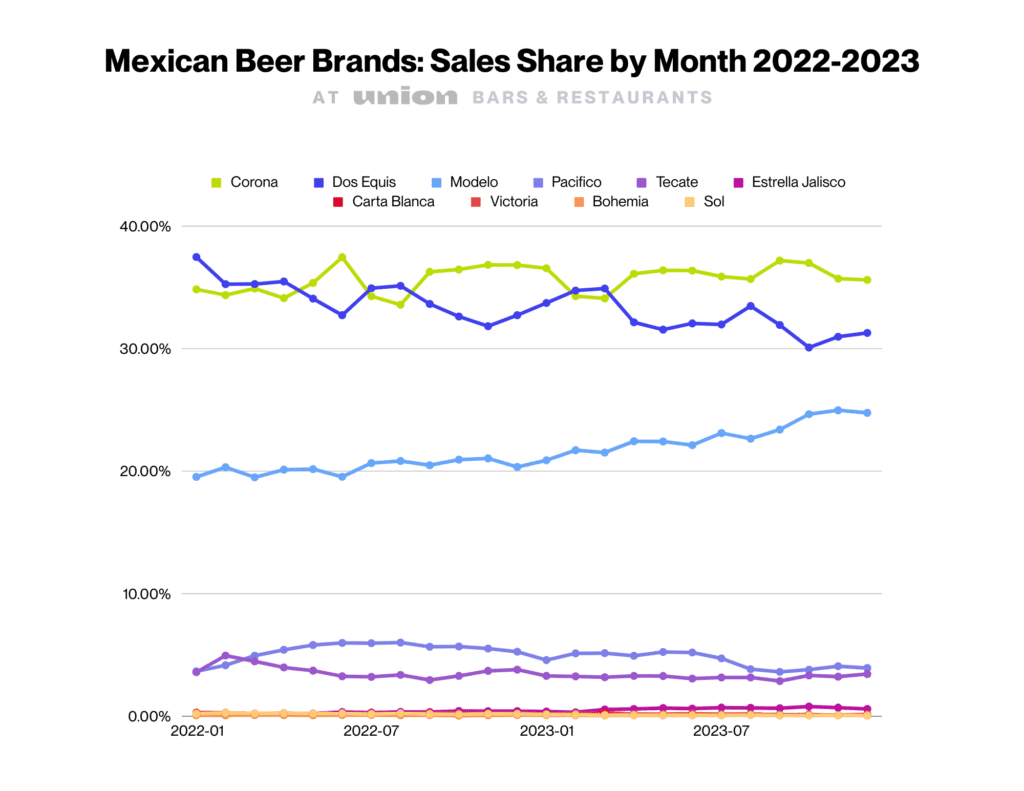

On-premise guests who are drinking Mexican Beer are drinking less of other types of beer, in particular less Bud Light. Union’s guest ordering data shows that the April 2023 Bud Light controversy had a direct positive impact for Corona, more so than Dos Equis or Modelo.

Guests who drank Bud Light pre-boycott were much more likely to switch to Corona after the controversy, while Modelo’s growth isn’t as clearly tied to the Bud Light shift when it comes to on-premise venues.

Ross explains, “Corona and Dos Equis were switching rank, back and forth between No. 1 and No. 2 until the moment of the Bud Light boycott. As Bud Light sales decreased, the other leading beer brands hustled for more market share. That’s the point at which Corona overtook Dos Equis on-premise.”

In comparison, Modelo’s growth trajectory pre-dates the boycott. Sales at Union have been up overall since June 2022, and Bud Light’s share losses simply fueled further growth for Modelo.

Mexican Beer Sales Trend Toward Lagers

To most American drinkers, a cerveza isn’t just any beer. It evokes a distinct style: an easy-drinking, Mexican lager that’s crisp and light, served with a squeeze of lime. And these lager-style cervezas make up the majority of Mexican beer sales.

Still, brand recognition matters. Dos Equis Ambar, Corona Familiar, and Modelo Negra — which all rank in the Top 10 Mexican Beer items sold at Union — are fuller bodied styles, while Corona Premier is a lower-carb, lower-calorie lager.

Top Mexican Beer Items

- Corona Extra

- Dos Equis Lager Especial

- Modelo Especial

- Pacifico Clara

- Tecate

- Corona Light

- Dos Equis Ambar

- Corona Familiar

- Corona Premier

- Modelo Negra

What’s Ahead for Mexican Beer

It’s not just Mezcal and Margaritas that are booming on-premise. Mexican-brewed beer is part of a larger trend.

Mexico is the top exporter of beer to the U.S. The Beer Institute reports that Mexico increased its beer exports by 9 percent in the 12-months ending November 2023. The other major beer export countries, like Ireland and the Netherlands, are seeing decreases in their percentage of exports.

Demand for these Mexican beverages has been driven by a host of influences, but shifting demographics and smart marketing have helped Mexican Beer boom in the U.S.

“Mexican Imports have been on a long trajectory of growth in the off-premise landscape,” says Williams, “so it is not surprising to see those trends translate into the on-premise landscape as well.”

According to Williams, evolving demographics across the U.S. over the years have played a factor in the rise of certain brands as the Hispanic population continues to grow and those shoppers look for authentic Mexican brands when making their selection. “A lot of these Mexican import brands also carry an image that is aspirational and prestigious, making them sought after in social occasions to elevate the moment,” he says.

Ross concludes: “The truth is that all eyes are on the top three Mexican beer brands for now, as Corona and Dos Equis battle it out on-premise, while Modelo continues its steady rise up the ranks.”