New data from Union’s high-volume bars and restaurants shows that a variety of Whiskey styles and brands with a more robust taste and premium prices — notably American Whiskey — are driving growth at on-premise.

Whiskey is now the third best-selling Spirits category in the U.S. on-premise, behind Vodka and Tequila, according to Union’s point-of-sale consumption data. The category accounted for about one-quarter of all Spirits sales during the 12 months ending November 2023.

Whiskey brands vying for on-premise sales are working within a much more competitive space compared to other Spirits categories. Within Tequila, for example, just a handful of brands are driving growth; and within Vodka, the top brand commands over 40 percent of Vodka sales share, according to a recent OnPrem Insights report.

Among a sea of domestic and international brands, Jameson Irish Whiskey, the leading on-premise Whiskey brand, holds the No. 1 spot with 22 percent sales share of all Whiskeys sold at Union bars and restaurants. The brand has built its success as a beginner’s Whiskey and a go-to party drink in the U.S. explains Layne Cox, chief marketing officer at Union.

“It’s true Jameson is ubiquitously popular across all types of settings, from sports bars to dive bars, but it’s Bourbon brands, in particular, that have shown considerable strength over the past year in this category,” says Cox.

American Whiskey Brands Gaining Share On-Premise

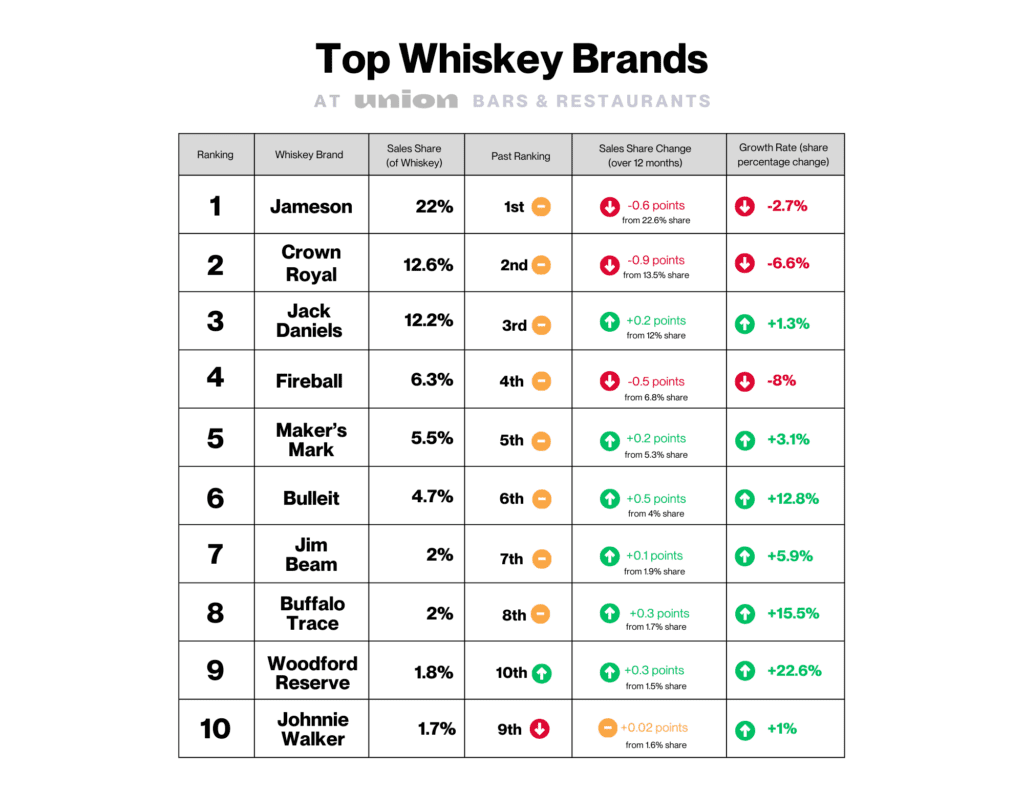

Among the top-selling Whiskey brands at Union, only American brands such as Jack Daniel’s and Maker’s Mark have been gaining significant share as of late, with Irish Jameson, and Canadian brands Crown Royal and Fireball, decreasing substantially over this 12-month period.

“At the rate that Crown Royal is declining and Jack Daniel’s is increasing, it’s possible we could see Jack Daniels bump up into the No. 2 spot in the coming year to overtake, or at least match, on-premise Crown Royal sales,” says Cox.

Brand popularity can also look different on a SKU level, she notes, citing Jack Daniel’s Black Label, which outsells Crown Royal’s flagship Whiskey. However, the Crown Royal brand is boosted into the No. 2 spot due to the popularity of its apple- and peach-flavored varieties.

Top Whiskey Brands at Union Venues

Bourbons including Bulleit, Buffalo Trace, and Woodford Reserve are driving the largest share gains amongst the top Whiskey brands. In fact, Woodford Reserve surpassed sales of Johnnie Walker Scotch during this period, improving its rank to secure the No. 9 spot.

Other top-selling brands not reflected in the Top 10 list include: Tullamore Dew, Basil Hayden, Skrewball, and Macallan, each representing over 1 percent sales share of all Whiskey sold at Union venues. Johnnie Walker lays claim to the top-ranked Scotch Whisky, while the top single-malt Whisky is Macallan. The top Japanese Whisky is Suntory’s Toki, though its share is well below one percent.

Just how important are brand names to Whiskey drinkers? Union data found that guests are more likely to call a brand for Whiskey-based cocktails than for Tequila-based cocktails. “Whiskey brands are some of the most recognizable and captivating alcohol brands in the world, from a marketing perspective,” Cox says. “The winning brands effectively connect with guests, giving them a compelling reason to choose one Whiskey over another.”

American Whiskey is Largest Subcategory at On-Premise — And Still Gaining Share

Whiskey brands certainly matter to guests. But in a category deeply defined by its subcategories, the provenance and style of the liquid in the bottle matters, too.

Though Jameson, an Irish Whiskey, boasts the highest sales for any Whiskey brand on-premise, American (non-Rye) Whiskey — led by Bourbon brands — wins as the largest subcategory, at nearly 46 percent of all Whiskey ordered at Union. And its share grew significantly last year, by nearly 5 percent, in the 12-month period ending November 30, 2023. By comparison, Irish Whiskey represents 25 percent, and Canadian 20 percent.

According to the Distilled Spirits Council of the United States, in 2022, more than 31 million 9-liter cases of American Whiskey were sold in the U.S. in 2022, representing nearly $5.1 billion in revenue for distillers.

Contributing to American Whiskey’s growth at Union are the established Kentucky Bourbon brands like Jim Beam, Maker’s Mark, Bulleit, and Buffalo Trace, as well as newer premium Kentucky Bourbon brands like Basil Hayden and Angel’s Envy. All other subcategories of Whiskey lost share to American Whiskey: Canadian Whiskey declined by nearly 7 percent, and Irish Whiskey by nearly 2 percent. One bright spot on the calendar for Irish Whiskey, of course, is during the March St. Patrick’s Day period, when American Whiskey loses some share to Irish Whiskey.

Cox explains that though Bourbon is overall more popular on-premise than any other style, those sales don’t necessarily translate to mega success for individual brands because of the proliferation of Bourbon brands in the U.S. market.

Looking at top brands by Whiskey subcategory, American Whiskey holds the record as the subcategory most likely to be reordered at guests’ next bar visit. It boasts a 74 percent retention rate, according to OnPrem Insights data.

Top Whiskey Brands at Union Venues, by Subcategory

American (non-Rye) Whiskey

- Jack Daniel’s (Tennessee)

- Maker’s Mark (Kentucky)

- Bulleit (Kentucky)

- Buffalo Trace (Kentucky)

- Jim Beam (Kentucky)

Irish Whiskey

- Jameson

- Tullamore Dew

- Redbreast

- Lost Irish

- Bushmills

Canadian Whisky

- Crown Royal

- Fireball

- Pendleton

- Seagram’s

- Black Velvet

Scotch

- Johnnie Walker

- Macallan

- Glenlivet

- Dewar’s

- Laphroaig

Rye

- Bulleit (Kentucky)

- Wild Turkey (Kentucky)

- Knob Creek (Kentucky)

- WhistlePig (Vermont)

- George Dickel (Tennessee)

Fastest Growing Whiskey Brands

According to Union data, these brands proved to be the fastest-growing Whiskeys, based on their rank change during the 12-month period ending November 30, 2023.

Fastest Growing Whiskey Brands at Union Venues

- Woodford Reserve (American, Kentucky)

- Blanton’s (American, Kentucky)

- Angel’s Envy (American, Kentucky)

- Buffalo Trace (American, Kentucky)

- Basil Hayden (American, Kentucky)

- Lost Irish (Irish)

- Bulleit (American, Kentucky)

- Four Roses (American, Kentucky)

- Tullamore Dew (Irish)

- Old Crow (American, Kentucky)

Woodford Reserve is the unrivaled success story of the past year at Union venues, having grown by over 22 percent. “For an established brand, that’s a remarkable increase. It says a lot about guests’ continued desire to drink premium Whiskey,” says Cox.

Notably, nearly all of the fastest-growing brands are Kentucky Bourbons, including Blanton’s, which grew by over 16 percent, jumping from No. 22 to No. 19, and Angel’s Envy, which grew by over 15 percent and is the No. 24 best-selling Whiskey at Union venues.

Cox adds, “Bulleit and Buffalo Trace are showing impressive growth, as well, and also ranking in the Top 10 of all Whiskeys sold at Union. That’s alongside mainstay brands like Johnnie Walker. These Kentucky Bourbons are a big draw for on-premise guests wanting to discover something new, something that speaks, very directly, to American culture and history.”

Some non-Kentucky brands are also having success, but at a more local level for the time being, with outsized sales for their brand at their distillery taprooms. Cox says these American Whiskeys have strong potential for further growth, especially if interest in Bourbon peaks for some guests, who might look for alternatives.

Lost Irish, an Irish brand now distributed by Southern Glazer’s Wine & Spirits that bills itself as a “modern” Irish Whiskey, recently entered the market. The Whiskey grew by over 13 percent — a strong rise for a newcomer brand to the U.S. on-premise, proving to be one of the top emerging Whiskey brands at Union coming out of this report. Redbreast (Pernod Ricard), another Irish Whiskey, has been growing in popularity on-premise, as well.

“While Jameson is a perennial on-premise best-seller, it seems that a wider range of Irish Whiskey brands like these are increasingly appealing to guests,” says Cox.

What Whiskey Consumers Want in 2024

Bourbon will continue to be a sales driver into 2024, Cox says. Expect to see even more Whiskey brands in the on-premise space into the new year, following off-premise trends where consumers are becoming more familiar with premium, and ultra-premium, Bourbons. Rye and American single-malts have potential to grow this year, as well, as guests look for more unique and robust flavors in their Whiskey.

“Union data points to the reliable best-sellers, like Jameson and Crown, staying on top. But with so much competition from American Whiskey brands continuing their collective share gain, the Irish Whiskey and Canadian Whisky subcategories will need to rethink how they can reclaim momentum,” she says.

Imbibers are also looking to understand more about the Whiskeys in their glass. “Consumers’ palates are more sophisticated than they are often given credit for,” says Leilani Howard, a brand ambassador for Bulleit, at Proof Media Mix.

Brands should focus on educating operators and bartenders, which will allow them “to have nuanced and persuasive discussions with patrons looking to try high-quality Whiskey,” Howard says. Bulleit is one brand that encourages operators to convey its depth and range of flavors to guests. It’s one part of a winning strategy that has earned Bulleit nearly 13 percent growth in on-premise over the past 12-months, she explains.

Cox adds: “There are so many interesting Whiskey brands, production styles, and memorable cocktails that operators can offer their guests. There’s a clear opportunity to drive sales via trialing experiences, whether Whiskey flights or bartender recommendations. Operators can build a following for their Whiskey programs by offering experiences that consumers won’t find at home.”