Tequila’s skyrocketing popularity is no secret. According to recent OnPrem Insights data, Tequila commanded nearly one-third of all spirit sales at Union venues, racing ahead of Whiskey sales. Meanwhile, Margaritas are far and away the most popular cocktail — during every month of the year. But what are the best-selling Tequila brands leading this trending category?

We’ve identified the top Tequilas and Mezcals at Union venues by dollar share in the 12-month period ending March 31, 2023 to offer insights on how to best stock your shelves with the bottles that drive sales. In a sea of brands that run the spectrum of prices and styles, just a few came out on top — a finding that highlights the importance of carrying the brands that matter the most to your guests.

“This new data will help operators forecast what the Tequila brand landscape may look like throughout the summer season and beyond,” said Layne Cox, Chief Marketing Officer at Union. “Because Union’s data is based on actual guest orders, it’s the most reliable snapshot of best-selling Tequila brands.”

Here’s everything you need to know about the top Tequila brands at high-volume venues across America.

Four Tequila Brands Take the Lead

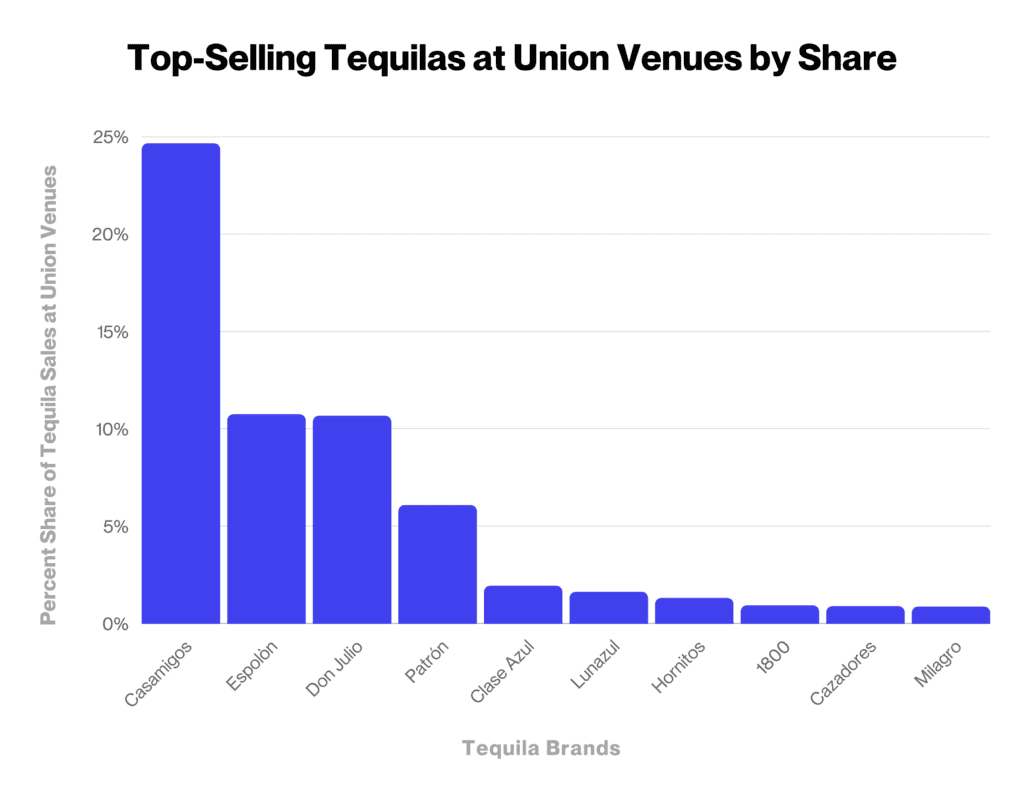

The four best-selling Tequila brands — Casamigos, Espolòn, Don Julio, and Patrón — appeared to be securely locked in, representing more than half of all Tequila sales at Union venues over the past year. Amongst the Call brands, Espolòn took a lead with 11 percent share across all sales. Remarkably, Espolòn stands out as the only Call Tequila to rank in the top five, amongst Premium brands.

Note: This report includes Mezcal brands alongside Tequila brands and is ranked by percentage share of all category sales, by dollar share. Union defines “Premium” brands as those that retail at higher price points; “Call” brands are mid-tier brands; “House/Well” brands are lower-priced brands that go nameless on a menu.

Union’s Top 25 Tequila/Mezcal Brands

- Casamigos

- Espolòn

- Don Julio

- Patrón

- Clase Azul

- Lunazul

- Hornitos

- 1800

- Cazadores

- Milagro

- Jose Cuervo

- Olmeca Altos

- El Jimador

- Del Maguey (Mezcal)

- Teremana

- Herradura

- Ilegal (Mezcal)

- Sauza

- Torada

- Lalo

- Exotico

- Dulce Vida

- Avion

- Cimarron

- Camerena

Union’s Top 5 Premium Tequila/Mezcal Brands

- Casamigos

- Don Julio

- Patrón

- Clase Azul

- Del Maguey (Mezcal)

Union’s Top 5 Call Tequila/Mezcal Brands

- Espolòn

- Lunazul

- Hornitos

- 1800

- Cazadores

Tequila House Drinks for the Win

Though Tequila is often ordered by brand name, House/Well Tequila drinks (the countless unspecified brands that are not listed by name on a menu) are still the most popular order amongst Union guests.

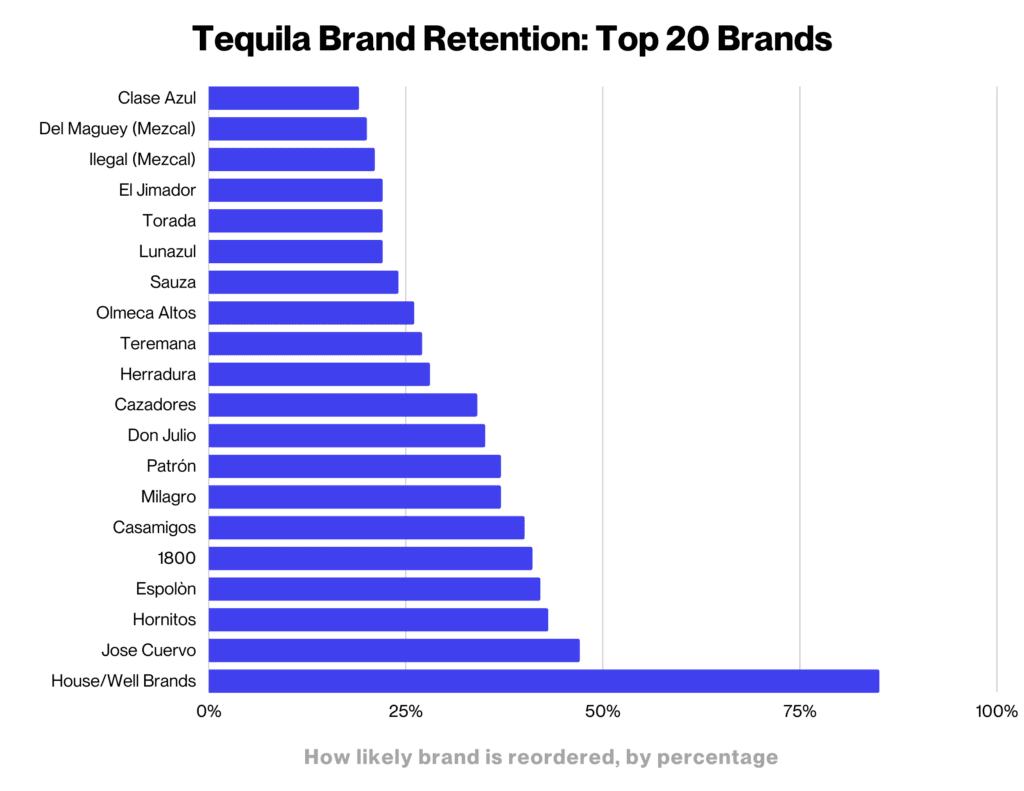

House/Well drinks represent a 31 percent share of Tequila drinks sold and enjoy an astounding 85 percent retention rate, meaning the customer will most likely reorder another House/Well drink at their next bar visit. Casamigos’ 40 percent and Espolòn’s 42 percent represent enviable retention rates. But they simply don’t compare to House/Well reorders.

Tequila Shows Lower Affinity Than Mature Spirits Categories

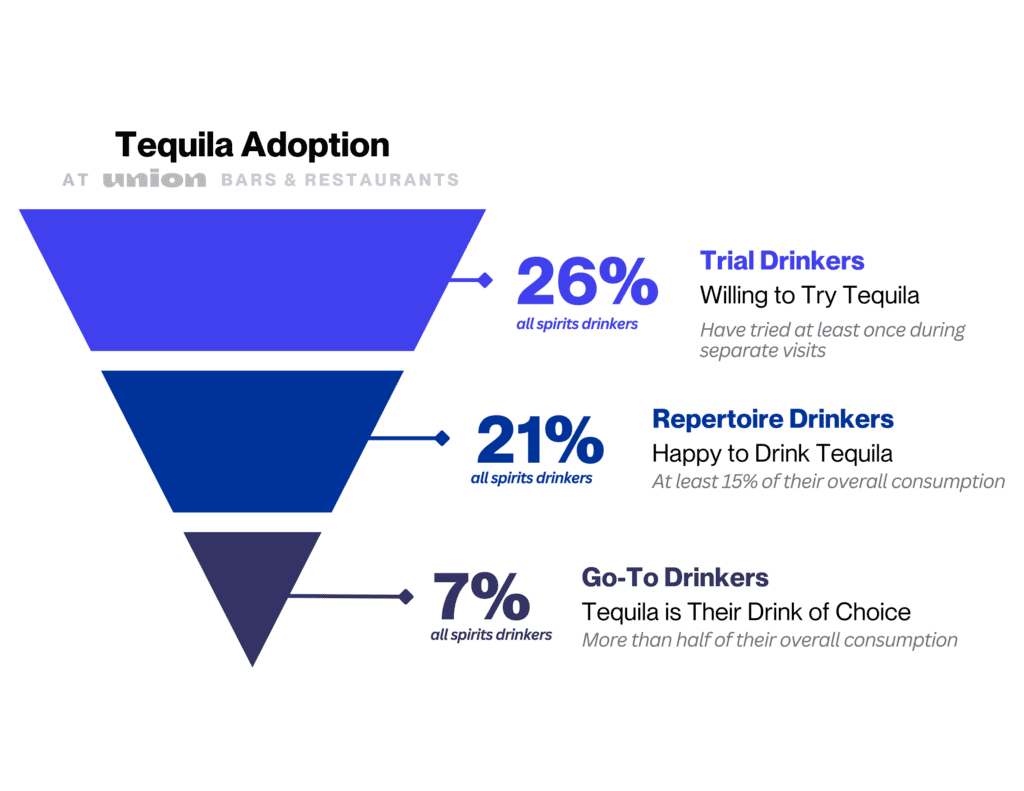

Tequila’s adoption funnel is solid, with 26 percent of all spirits drinkers having ordered it at least once within a five-visit period, and seven percent making it their drink of choice. Union buckets consumers into three segments based on their adoption rate: “Trial” drinkers, “Repertoire” drinkers, and “Go-To” drinkers. Despite the category’s growing sales, its segment of Go-To drinkers — representing consistent repeat orders — could be stronger.

When it comes to category affinity, Tequila’s dollar sales rival Vodka and Whiskey, but its adoption funnel rates by units still fall slightly below in comparison. For guests that purchased Tequila at least once within a five-visit period, 81 percent came back to it (compared to 88 percent for Vodka, and 85 percent for Whiskey), and of those 32 percent went on to order Tequila on at least half of their subsequent visits (compared to 40 percent for Vodka and 39 percent for Whiskey).

It remains to be seen if adoption rates and overall loyalty to the category will improve — or ever catch up with Vodka and Whiskey adoption rates — as the Tequila category matures.

Sales Opportunities: Think Big with Tequila

“A thoughtfully crafted Tequila menu is a smart investment for bars and restaurants looking to maximize sales,” said Cox. “It’s always smart to leverage ordering data to stay on the pulse of what your guests are ordering — and reordering — as this category continues to rapidly evolve.”

Want to update your Tequila menu but not sure where to start? Try out a few of these suggestions geared for bar/restaurant operators and Tequila brand managers looking to capitalize on their spirits sales. Be sure to check out our article on the top-selling Tequila cocktails, as well.

Recommendations for Venues

- Stock Your Inventory with Best-Selling Tequila Brands – Or at least with a similar mix of brand profiles.

- Carry More Premium Tequila and Mezcal – And promote it to your guests, who are looking for new top-shelf brands to try out.

- Assess Your House/Well Drink Pricing Strategy – They get reordered time and time again, so price and promote them accordingly.

Recommendations for Brands

- Don’t Focus Entirely on Premium Products – There are growth opportunities for mid-tier and lower-priced Tequilas as well, especially in cocktail programs.

- Get Market-Specific – Build your brand in specific markets so guests come to associate it with a venue, city, or region, to help gain a toehold alongside top-selling brands.

- Differentiate Your Brand From the Mainstream – Promote your brand as unique and interesting to an increasingly Tequila-savvy crowd.