It’s a golden age for ready-to-drink (RTD) alcohol, with new and innovative product launches hitting the market in record numbers this year. The wide variety of flavors and brands drives the fast-growing category’s appeal, especially at retail. Yet for on-premise, new data from Union’s OnPrem Insights shows that just a handful of RTD brands still dominate bar and restaurant sales.

Two RTD brands led on-premise in the 12 months ending the first quarter of this year: White Claw and High Noon. But the category is rapidly evolving, and it’s not clear yet whether on-premise will ever follow off-premise RTD trends. In this report, we looked at this evolving category to see which RTDs are being consumed by guests at on-premise venues.

“RTD alcohol is a rapidly expanding category even though it represents a small percentage of sales in the on-premise channel. At this point, there’s clear-cut brand domination, with White Claw and High Noon far ahead of the pack at Union venues,” says Lance Obermeryer, PhD, Union’s Chief Scientist. “There are likely a variety of reasons for this, from consumer brand loyalty to operators’ desire to maintain a focused inventory. With brand names dominating RTD sales, bars and restaurants should apply this insight to optimize their menu offerings.”

On-Premise RTD Alcohol at a Glance

At Union bars and restaurants, RTDs are available at nearly three out of four venues and represent about 1.3 percent of alcohol sales by dollar share. It’s a relatively small piece of the pie, but when you consider that they comprise seven percent of the overall Beer/RTD category, it’s easy to see how RTDs have risen to become a noteworthy category in just a few short years.

While sales for RTDs are not as strong in the on-premise channel as compared to off-premise, many operators see an upside to offering single-serve, canned RTDs alongside their hand-poured drinks. From the operator perspective, RTDs are easy to serve and have a long shelf life. And for consumers, there’s seemingly something for everyone, as high-quality offerings have become available in a range of flavors, ABV-levels, and alcohol bases. In fact, a recent report by OnPrem Insights shows that sales for spirit-based or malt-based RTDs are determined in part by guests’ spirit or beer drinking preferences — spirits drinkers gravitate to spirits-based RTDs, while beer drinkers more frequently order malt-based RTDs.

White Claw Leads, but High Noon is Unchallenged Champ of Spirit-Based RTDs

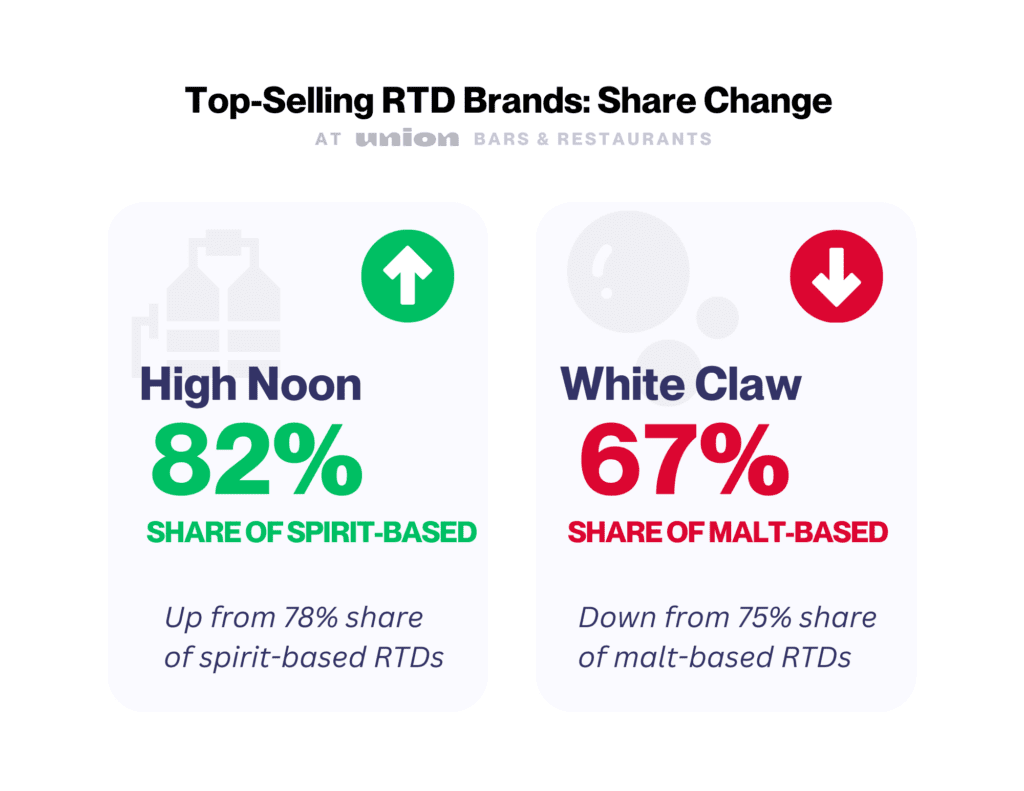

Overall, White Claw is the No.1 selling RTD brand at Union venues. That’s no surprise given hard seltzer’s long-time command of the RTD space. However, within the malt-based RTD subcategory, White Claw has dropped from 75 percent share to 67 percent share of all malt-based RTDs.

White Claw’s top five competitors in the malt-based subcategory represent 30 percent of sales share. Truly, the No. 2 malt-based RTD, represents White Claw’s biggest competitor in the space at 13 percent share. Twisted (5 percent share), Topo Chico (7 percent), and Smirnoff Ice (under 1 percent) are showing growth and appear to be taking share from White Claw.

For spirit-based RTDs, our data shows the High Noon brand is relatively unchallenged at Union venues. It dominates spirit-based RTD sales with a whopping 82 percent share of all spirit-based RTDs, growing from 78 percent in the past year. Its top five competitors in the spirit-based subcategory represent only 18 percent of sales share. Nütrl, a relatively new brand that had 10 percent growth in the past year, is High Noon’s key challenger at 12 percent, and all others are 3 percent or below. Canteen’s share dropped by 11 percent to 3 percent in the past year.

According to the Distilled Spirits Council of the United States (DISCUS), spirit-based RTDs are showing significant market growth. A recent study by the organization revealed that consumers increasingly prefer spirit-based RTDs, with 55 percent of survey respondents preferring spirit-based to other RTD choices. Similarly, IWSR predicts spirit-based RTD volume will grow at an average rate (CAGR) of 33 percent in the U.S. by 2025. That makes High Noon’s notable share gains a remarkable feat despite a barrage of new launches, innovative flavors, and expanding portfolios in this subcategory.

“The entire RTD segment is experiencing growth, regardless of alcohol base,” says Britt West, Senior Vice President and General Manager of Spirit of Gallo, which owns High Noon. “Spirits RTD growth is based on a consumer desire to take spirits to occasions that were previously dominated by malt and sugar-based beer. Think about stadiums, the beach, tailgates, and festivals. If you were not a beer drinker, your choice in beverage alcohol was extremely limited. This holds true in on-premise as well,” he said.

West added some advice for bars and restaurants: “If the account sells beer, they should sell RTDs,” he says. He explained that RTDs do not cannibalize spirits sales because the consumer in the RTD occasion is often looking for a sessionable, low-ABV product.

So Many Flavors — But More RTD SKUs Do Not Equal More Sales

RTD suppliers have added more and more flavors over time. That SKU proliferation has forced venues to decide how many individual items to stock. But in on-premise, do more flavors result in more sales? Or are they a hassle to operators, and considered noise by guests?

Our data shows that some additional flavors can be incrementally beneficial, but for venues with limited refrigerator space, you can still capture significant sales with just a few key flavors. For White Claw, that’s Black Cherry and Mango, and for High Noon, it’s Lime and Pineapple. Both of these RTD brands have more than 50 percent of share in their top two flavors. There is in fact a positive correlation between the number of flavors and the share of White Claw and High Noon sold, but the correlation is not strong, indicating that a lower number of flavor options will offer operators similar results with fewer SKUs.

While the five top flavors listed below reign at Union, newer products like Topo Chico are introducing more complex and sophisticated flavors, like Tangy Lemon-Lime and Strawberry-Guava.

Top RTD Flavors at Union Venues

Ranked by numbers of units sold

- Black Cherry

- Lime

- Mango

- Pineapple

- Berry

The Top-Selling RTD Brands at Union

Though White Claw and High Noon lead sales, many RTD brands are available across Union bars and restaurants. Note that this list is ranked by dollar sales share. However, ranked by number of units sold, High Noon beats White Claw.

Top-Selling RTD Brands Overall at Union

Ranked by dollar sales share

- White Claw

- High Noon

- Truly Hard Seltzer

- Nütrl

- Topo Chico

- Twisted Tea

- Bud Light Seltzer

- The Long Drink

- Canteen

- Smirnoff Ice

Top-Selling Malt-Based RTD Brands at Union

Ranked by dollar sales share

- White Claw

- Truly Hard Seltzer

- Topo Chico Hard Seltzer

- Twisted Tea Hard Iced Tea

- Bud Light Seltzer

- Smirnoff Ice

- Karback Hard Seltzer

- Lone River

- Two Robbers

- Maui Hard Seltzer

Top-Selling Spirit-Based RTD Brands at Union

Ranked by dollar sales share

- High Noon

- Nütrl

- The Long Drink

- Canteen Spirits

- Cutwater Spirits

- Slim Chillers

- Elenita Sparkling Mezcal

- Topo Chico Hard Seltzer

- Truly Vodka Soda

- Coral Spirits & Company

The Top-Selling RTD Items at Union Bars and Restaurants

Across malt-based and spirit-based RTDs, the top items sold at Union bars and restaurants stood out for their focus on fruity flavors. Mango, lime, and pineapple appear in the top five items for both RTD bases. White Claw’s signature black cherry flavor, however, was the most popular item.

Top-Selling Malt-Based RTD Items

Ranked by number of units sold

- White Claw Black Cherry

- White Claw Mango

- Twisted Tea Original

- White Claw Natural Lime

- Topo Chico Tangy Lemon-Lime Hard Seltzer

- White Claw Watermelon

- White Claw Raspberry

- Truly Hard Seltzer Wild Berry

- Topo Chico Strawberry-Guava Hard Seltzer

- Bud Light Seltzer Black Cherry

Top-Selling Spirit-Based RTD Items

Ranked by number of units sold

- High Noon Lime

- High Noon Pineapple

- High Noon Peach

- High Noon Watermelon

- High Noon Mango

- High Noon Black Cherry

- The Long Drink Traditional “

- Nütrl Pineapple

- High Noon Grapefruit

- High Noon Passionfruit

Will the same RTD off-premise trends eventually reach on-premise? It’s yet to be seen if new products (many offering higher ABV) such as Coca-Cola Jack Daniels, Jim Beam Coolers, and Spindrift Spiked will shake things up this year for the two RTD brands that have long-enjoyed the spotlight.

“This is a dynamic category, and the competition is fierce,” Obermeyer says. “Anything’s possible over the coming year and we’ll continue to report on the guest purchase behavior data to uncover how RTD brands are evolving on-premise at Union bars and restaurants.”