Ready-to-drink (RTD) sales have been on a steady upward trajectory, growing at a faster rate than most other alcohol segments. Market research company IWSR reports that RTD volume is expected to double its total market share of total beverage alcohol to eight percent by 2025, up from about 4 percent in 2020.

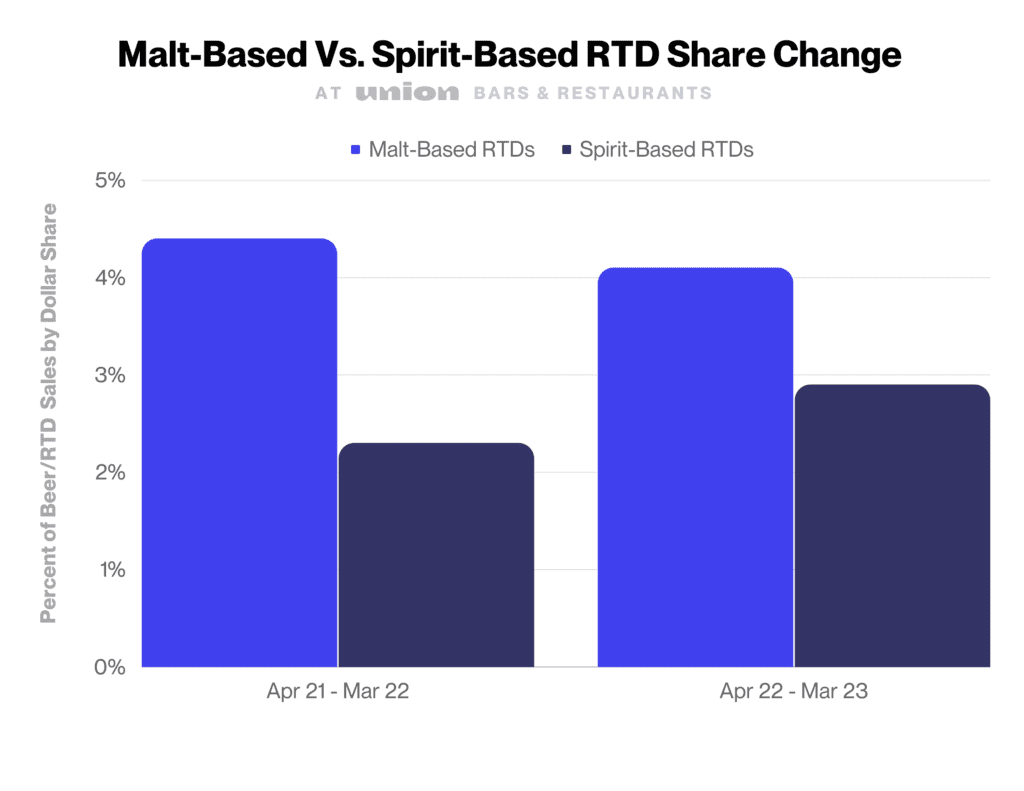

Still, RTDs represent a relatively small piece of all on-premise alcohol sales, totaling 1.3 percent of alcohol sales by dollar share at Union’s high-volume bars and restaurants, and representing 7 percent of the Beer/RTD category. But it’s growing and experiencing significant shifts across two distinct malt-based and spirit-based subcategories.

“RTDs had high at-home adoption at the height of the pandemic, and now we’re starting to understand how — and how often — guests are consuming them on-premise. With data from actual guest purchases in the last year at Union venues, we can see that beer drinkers drink relatively more malt-based RTDs and that spirits drinkers more spirit-based RTDs,” said Cody Treybig, Head of OnPrem Programming at Union. “This insight is going to change the way venue operators create their menus and market their RTD offerings.”

To meet the demand and evolving tastes for RTD options, venue operators need to know how to capitalize on the preferences of RTD drinkers, especially as more “bar quality” RTD products come to market. We took a look at how consumption has changed in the 12-month period ending March 2023 for malt-based and spirit-based RTDs (the most popular RTD options at Union) to help operators find out what’s driving these purchases and how to best position these products on their beverage menus.

Spirit-Based RTDs Gaining Ground

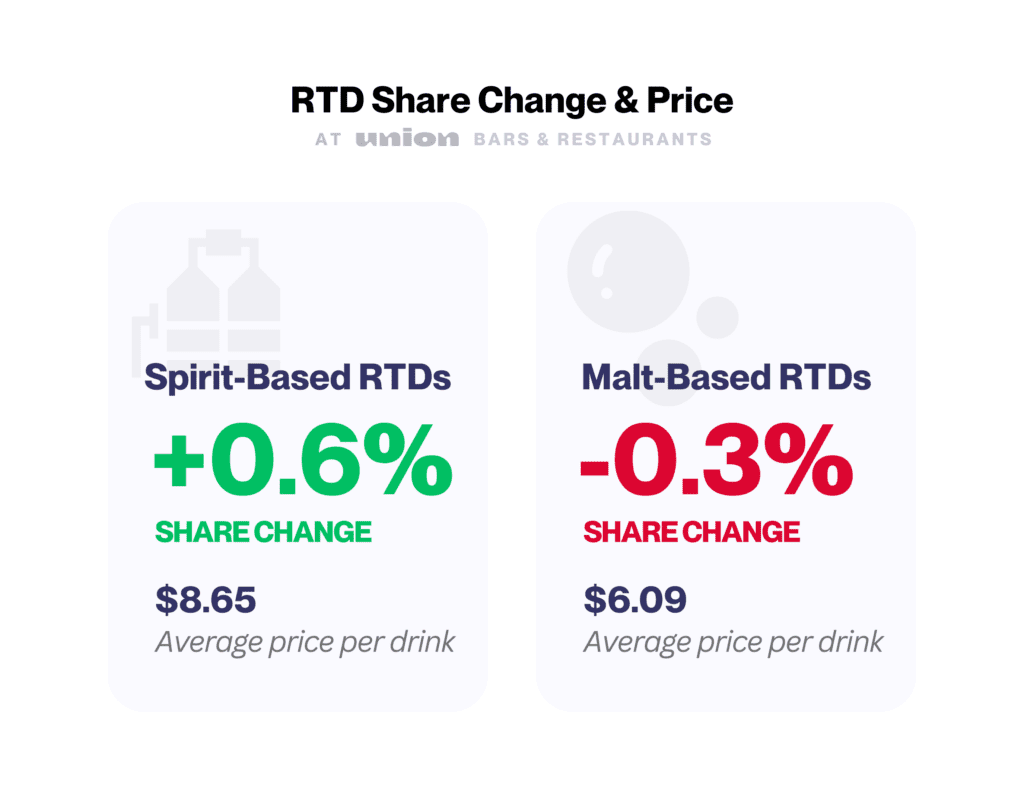

While RTD share grew at Union venues by 0.2 percentage points in this 12-month time period, it’s important to look at the category as a dynamic mix of unique drinks. Why? For RTD drinkers, it’s all about their alcohol base. Malt-based RTDs like White Claw and Truly Hard Seltzer sold more than spirit-based RTDs like High Noon and Nütrl Vodka Seltzer both in this period and the previous 12-month period. However, they are clearly experiencing different trajectories. And with so many mainstream brands launching RTD products this year, the category is poised for a further shake up.

Note: This report does not include wine-based or non-alcoholic RTDs.

Like most drinks riding the premiumization trend, price seems to be no deterrent to an increase in sales. At an average price per drink of $8.65 at Union venues, spirit-based RTDs cost guests about $2.50 more per drink compared to malt-based RTDs. Yet the higher-priced spirit-based RTDs are gaining share, while malt-based RTDs are on the slight decline.

Beer and Spirit Drinkers Stick to Their Preferences

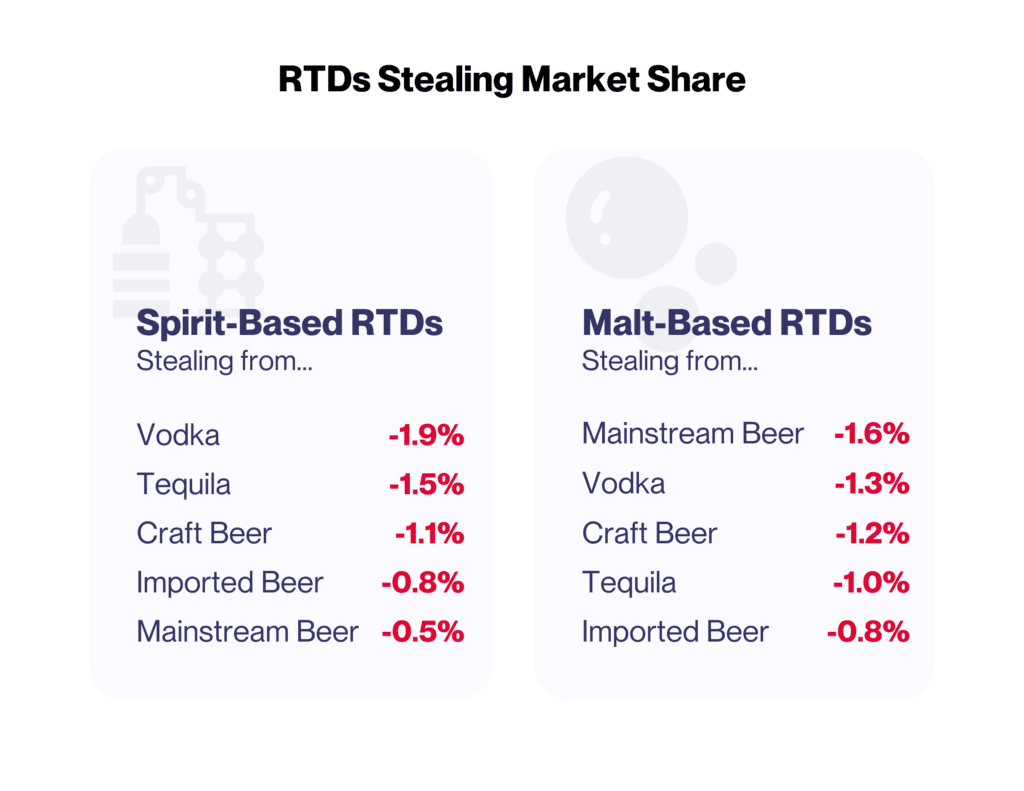

Just because they both come in a can, malt-based and spirit-based RTDs are not necessarily directly in competition with each other, according to Union data. Interestingly, beer drinkers skew to malt-based RTDs and spirits drinkers lean toward spirit-based RTDs. In other words, the categories from which malt-based and spirits-based RTDs pull share are not the same.

In the big picture, spirit-based RTDs are preferred by spirit drinkers more so than beer drinkers — and vice versa. More specifically:

- Spirit-based RTD drinkers are trading primarily from Vodka and Tequila

- Malt-based RTDs drinkers are trading primarily from Mainstream Beer and Vodka

- Both RTD types pull equally from Craft and Import Beer drinkers

- Neither RTD types are appreciably pulling from Wine drinkers

Mainstream Beer is the top “before” category for the malt-based RTDs, whereas Vodka is the top for spirit-based RTDs.

Sales Opportunities: Appeal to More RTD Drinkers

Convenient, pre-mixed drinks are increasingly found on bar menus alongside traditional on-premise beverage service. More bars and restaurants are experimenting with canned drinks as they look to alleviate bar staffing shortages and speed up serving times — and operators can drive sales by better targeting their menu to RTD drinkers’ preferences.

“It’s a dynamic segment with an increasing number of brands hitting the market, including higher-ABV and big-name brand collaborations. This report’s findings will help operators and brands sell the right RTDs to the right guests,” said Treybig.

The RTD segment is particularly interesting for its skyrocketing growth. Now, with these insights — based on actual guest purchases — operators can actively connect with their guests and optimize their menus more effectively.

Recommendations for Venues

- Consider the Base to Cover Your Bases – Stock at least one malt-based and one spirit-based RTD to address two distinct customer types.

- Highlight the Range of Alcohol Volumes – With higher-ABV RTDs coming to market, consider listing ABVs, just like you might for Craft Beers.

- Hone In On Your Target Drinker – Promote spirit-based RTDs to Vodka drinkers and malt-based RTDs to Mainstream Beer drinkers through smart back bar and menu placements.

Recommendations for Brands

- Target Your Customer – Be smart about targeting your customer, making sure you understand their preferences at a more granular level so you get the right RTD into the right hands.

- Go Premium, Baby! – Spirit-based RTD drinkers are drawn to premium positioning, and are willing to pay for it.

- Push the Big Picture – Bar and restaurant margins may not be as high on RTDs, so pitch their other benefits, such as lower operational pressures — with less glassware and fewer bartenders required.