Heading into 2024, OnPrem Insights is taking a look at whether the high-flying Espresso Martini cocktail trend is showing any signs of slowing — or whether it’s a drink trend with viable staying power.

The Vodka and coffee drink made headlines in 2022 as one of the year’s trendiest cocktails. It rose to the Top 10 of most-ordered drinks in the U.S., according to CGA by Nielsen IQ. Datassential found the cocktail was up 164 percent over the past four years according to Nation’s Restaurant News. And CNN Business called the Espresso Martini the “Drink of the Year.”

The caffeinated cocktail’s trajectory looks promising, as well, according to guest ordering data from Union’s high-volume bars and restaurants during the 12-month period ending September 30, 2023.

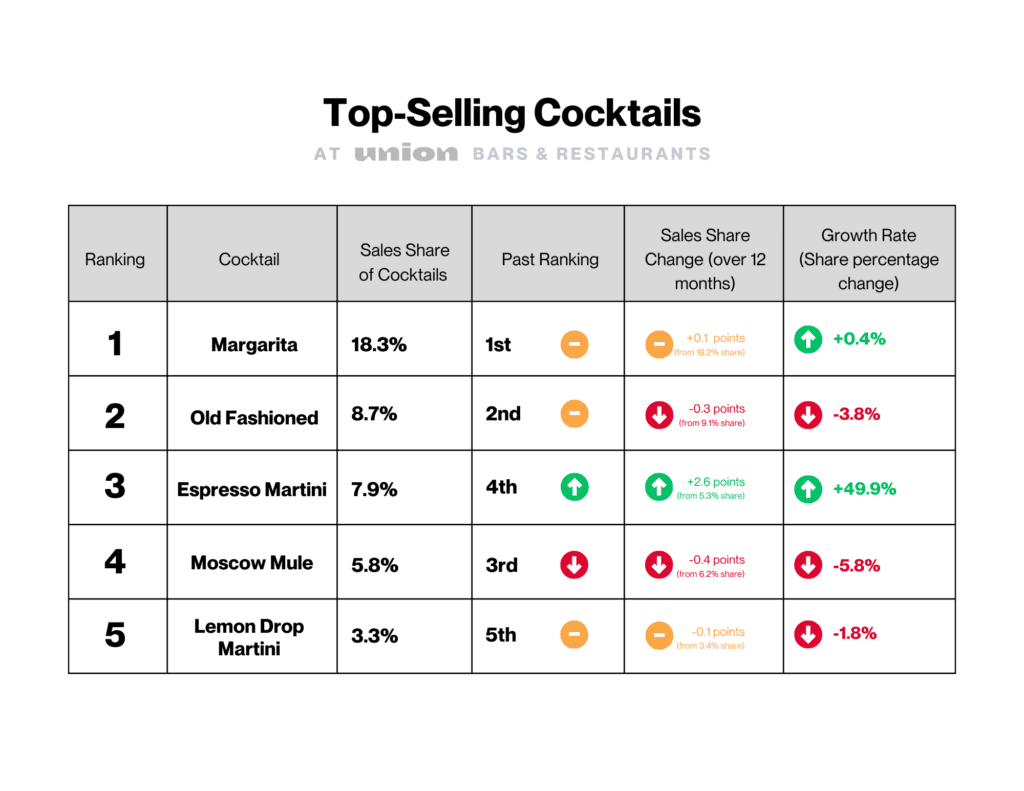

“The latest Union data shows that the Espresso Martini is very much still on trend. In fact, it grew by 50 percent in this 12-month period, becoming Union’s No. 3 top-selling cocktail, having bumped the Moscow Mule, which is now No. 4,” says Gary Ross, Union’s chief growth officer.

Espresso Martini Joins Ranks of the Old Fashioned and Margarita

The Espresso Martini stands as a genuine modern classic, says Olivia Kupfer, global brand director at Diageo, the company that owns Mr Black, the premium cold brew coffee liqueur, which is often used in high-quality Espresso Martinis. “Consumers are increasingly drawn to the sophistication and craftsmanship that characterize this cocktail,” she says.

She adds that the cocktail is a ritual for guests, and that’s part of the appeal. “You always see groups of friends enjoying [the cocktail] in bar or restaurants … it’s had in a social, higher-energy moment that can be shared.”

Invented some 40 years ago in the 1980s at a London bar, the drink has made a definitive comeback in recent years. The simple recipe of Vodka, coffee liqueur, and espresso is shaken until foamy and served dramatically in a stemmed Martini glass, making it a visual statement.

Since then, the distinctive, bold-flavored cocktail has experienced a resurgence stemming from the merging of two great consumer trends: high-end coffee and high-end cocktails,” explains Aleco Azqueta, Grey Goose‘s vice president of marketing in North America. “For a long time, it was considered a dessert cocktail, but in recent years it has become a popular cocktail to start a night or when ‘vibe dining,’ and even during brunch.” He says the revival of the Espresso Martini (and Martini-style drinks overall) have resulted in increased Vodka sales and reinforced the coffee-flavored cocktail’s rank among guests.

For many guests, a night out isn’t complete without the coffee-flavored cocktail. In the 12-month period of this report, eight percent of all cocktails and mixed shots ordered on-premise at Union venues were Espresso Martinis.

As the Espresso Martini has steadily climbed the charts, it has replaced the Moscow Mule, securing the No. 3 position as an on-premise best-seller. “It’s incredible to see just how popular it has become, with 50 percent growth just in the last year alone. In the span of just a few years it’s become nearly as popular as an Old Fashioned,” notes Ross.

Azqueta echoes the sentiment, adding that Grey Goose has experienced a domino effect of sorts, stemming from the Espresso Martini’s rise — and the fact that Vodka is in its DNA.

“The Espresso Martini is a classic Vodka cocktail, and the cultural appetite for it has actually opened the door for consumer exploration into other Martini variations,” he says. The French Martini, Cosmopolitan, and Lemon Drop have become a bigger part of Grey Goose’s cocktail strategy, he notes, and he’s now seeing them experience their own moment in culture as a result.

The Espresso Martini is Beloved Year-Round — AND Especially at Dinnertime

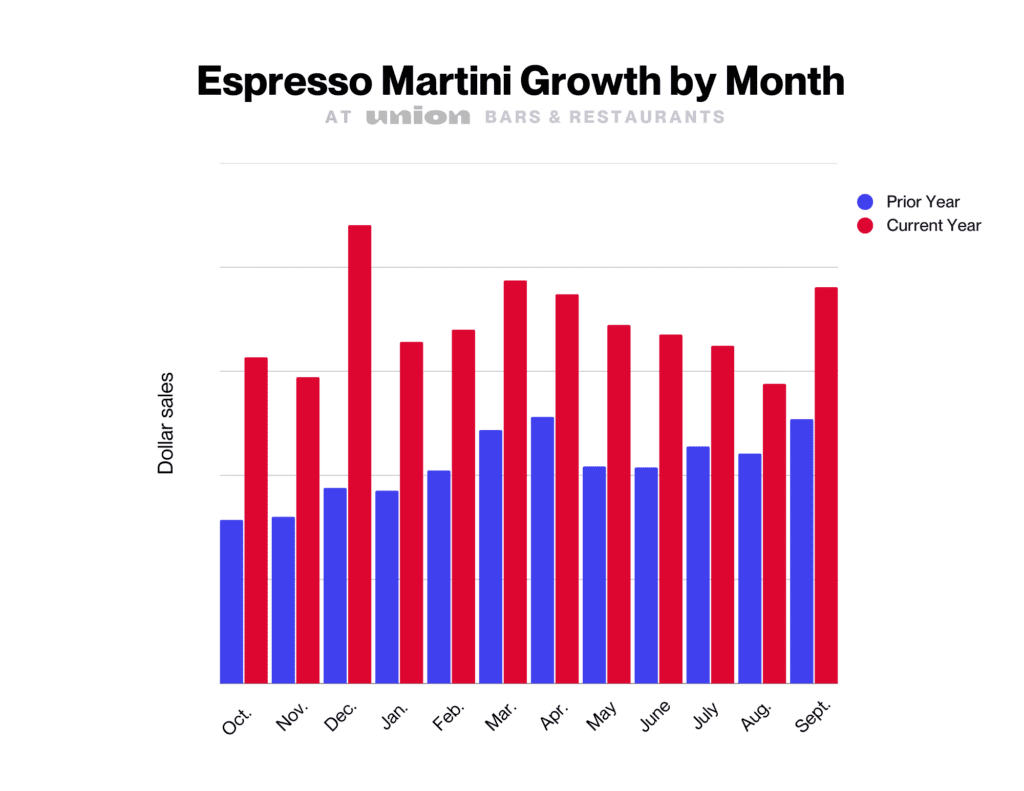

One important takeaway for operators is that Espresso Martinis are a year-round performer. According to Ross, “Espresso Martini sales are spread fairly evenly throughout the year, with a spike around the holidays in December. And excitingly, sales have been up significantly every month in the past year vs. the prior year.”

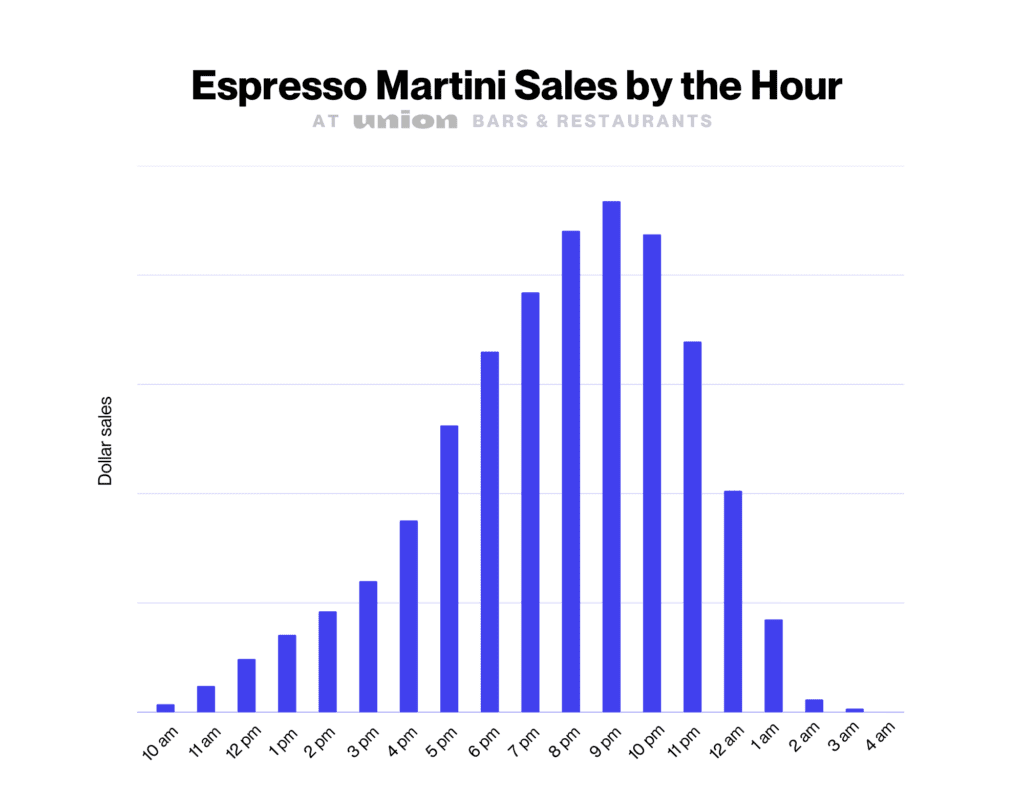

“Think of this drink as the refined version of the Red Bull and Vodka for the Millennial generation,” Ross says. “It has the same energizing effect that makes it a popular choice for getting the party going.” And the caffeinated Espresso Martini is not just a late-night drink. Union data shows that it peaks around the late Dinner daypart, likely as a post-meal indulgence or “pre-game” pick-me-up, before a night out.

Source: OnPrem Insights, 12-month period ending September 30, 2023.

In the 9 pm hour of the Dinner daypart, Espresso Martinis are at their most popular, commanding over 13 percent share of all cocktails and mixed shots sold. In fact, the Espresso Martini outperforms average cocktail sales by 8 percentage points during Dinner daypart. On Saturdays, it outperforms average cocktails by 10 points.

Union data also revealed who is ordering them the most. Women who order cocktails are 59 percent more likely to order an Espresso Martini than men who order cocktails.

Looking Ahead to 2024: What’s Next for the Espresso Martini?

“Over the past year, we’ve observed bartenders taking the Espresso Martini to new heights, experimenting with alternative base spirits like Tequila and introducing unique toppings such as Parmesan cheese,” says Diageo’s Kupfer. The Mr Black brand hosted a week-long Espresso Martini Fest with over 220 participating bars across 14 U.S. cities this year, where creative riffs on the cocktail were on full display, from a chocolate-covered strawberry version, to a labneh egg foam top, to a Venezuelan Rum-based Espresso Martini.

She adds: “As we look ahead, we anticipate continued growth and evolution in the Espresso Martini space with bartenders not only continuing to craft innovative variations of this classic but exploring new dimensions in coffee cocktails.”

While the cheese-dusted variations aren’t yet a hit everywhere, Azqueta sees plenty of experimentation. For example, using a flavored Vodka like Grey Goose L’Orange to add a bright but approachable twist to the original.

Espresso Martinis appear in many forms on drink menus at Union venues, from “Nitro” and “Cold Brew” variations to a range of flavor riffs, including vanilla, hazelnut, and salted caramel. Many venues are having fun with cocktail names for their Espresso Martinis, with monikers like the Go-Go, Royal Jolt, Wake Up Call, and the No Sleep Till Brooklyn Martini.

Given the drink’s enduring popularity, more innovative takes are on the horizon for larger venues, says Ross, such as Mezcal versions or non-alcoholic variations. Plus there’s the halo effect, where we can expect to see other drinks infused with coffee flavors, like an Espresso Old Fashioned.

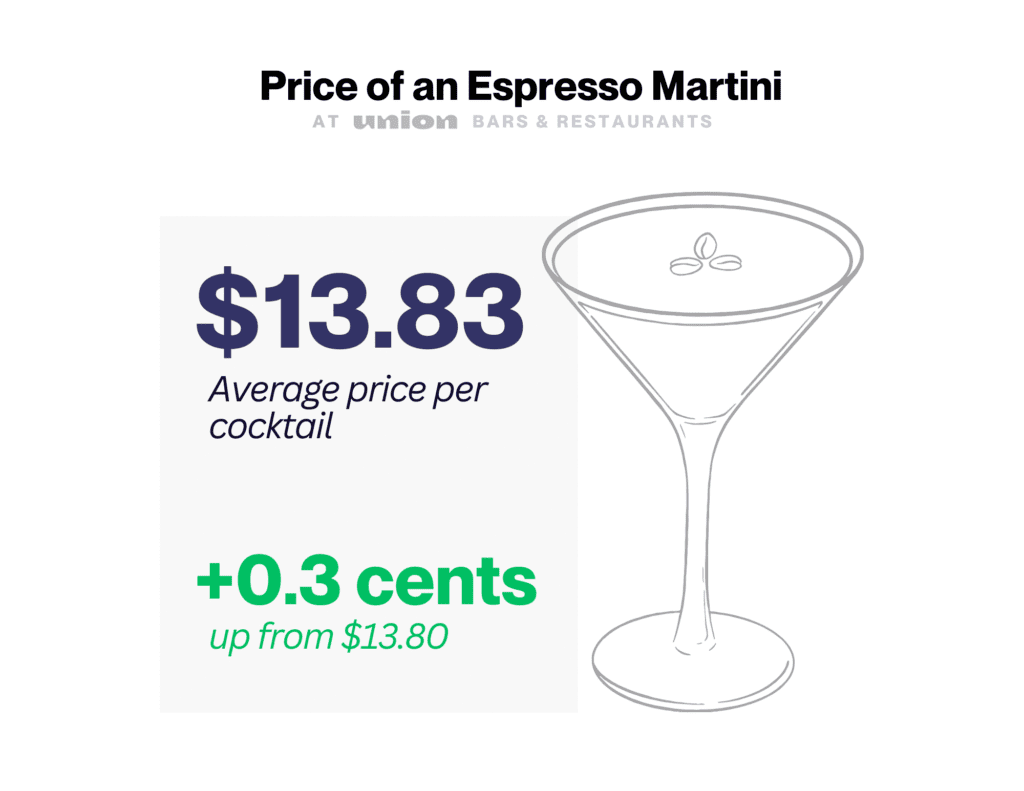

If there’s one takeaway that should capture operators’ attention, says Ross, it’s that guests are willing to pay a premium for a delicious Espresso Martini. This modern classic — often made with premium ingredients — is one of the most expensive Cocktails sold on-premise, now priced just below the Negroni, Manhattan, and Mezcalita in average price per drink across all Union U.S. venues.

Prices have risen across the board this year for top-selling cocktails (on average between 2 and 14 percent), however, the price of an Espresso Martini has not increased.

“Even though it continues to be priced at a premium, we see relatively flat pricing for the Espresso Martini over the past 24 months, despite its growing popularity. Nearly all other Cocktails experienced a significant price hike in the past year, but, on average, not the Espresso Martini,” explains Ross. “It seems operators may have some leeway to increase prices slightly for this on-trend drink, especially as they innovate with high-quality flavors and ingredients.”

Photo courtesy of Mr Black, Deitch Pham Photography